Cost Allocation for Rate-Making Purposes: Failsafe Insurance, Inc.. asked the regulatory board for an increase in the

Question:

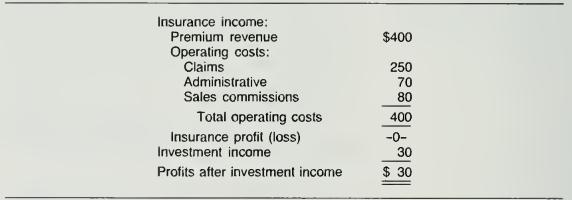

Cost Allocation for Rate-Making Purposes: Failsafe Insurance, Inc.. asked the regulatory board for an increase in the allowed premiums from its insurance operations. Insurance premium rates in the jurisdiction in which Failsafe operates are designed to cover the operating costs and insurance claims. As a part of Failsafe's expenses, its agents earn commissions based on premium revenues. Premium revenues are also used to pay claims and to invest in securities. Administrative expenses include costs to manage the company's invest- ments. All administrative costs are charged against premium revenue. Failsafe claims that its insurance operations "just broke even" last year and that a rate increase is necessary. The following income statement (in millions) was submitted to support Failsafe's request:

Further investigation reveals that approximately 20 percent of the sales commis- sions may be considered related to investment activities. In addition, 10 percent of the administrative costs are incurred by the investment management division. The state insurance commission (which sets insurance rates) believes that Failsafe's insurance activities should earn about 5 percent on its premium revenues.

Required:

a. If you were a consumer group, how would you present Failsafe's income state- ment? (For example, how would you allocate administrative costs and sales commissions between the "insurance income" category and the "investment income" category?)

b. If you were Failsafe's management, what arguments would you present in support of the cost allocations included in the above income statement?

Step by Step Answer: