Cost Flows through Accounts: Donegal Woolens employed 20 full-time knitters at $5 per hour. Since beginning operations

Question:

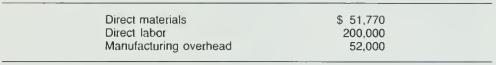

Cost Flows through Accounts: Donegal Woolens employed 20 full-time knitters at $5 per hour. Since beginning operations last year, they had priced the various jobs by applying a markup of 20 percent on direct labor and direct material costs. However, despite operating at capacity, last year's performance was a great disappointment to the managers. In total. 10 jobs were taken and completed, incurring the following total costs:

Thirty percent of the $52,000 manufacturing overhead was variable overhead; 70 percent was fixed.

This year Donegal Woolens expected to operate at the same activity level as last year, and overhead costs and the wage rate were not expected to change.

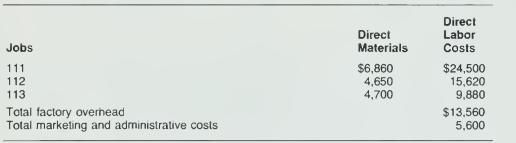

For the first quarter of this year, Donegal Woolens had just completed two jobs and was beginning on the third. The costs incurred were as follows:

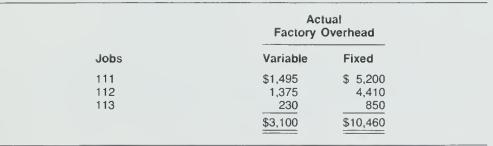

You are a consultant associated with Vesting Concerns Management Consultants, the firm Donegal Woolens has approached. The senior partner of your firm has examined Donegal Woolens' books and has decided to divide actual factory over- head by job into fixed and variable portions as follows:

In the first quarter of this year, 40 percent of marketing and administrative costs were variable and 60 percent were fixed. You are told that Jobs 1 1 1 and 1 12 were sold for $42,500 and $27,500, respectively. All over- or underapplied overhead for the quarter is expensed on the income statement.

Required:

a. Present in T-accounts the full absorption, actual manufacturing cost flows for the three jobs in the first quarter of this year.

b. Using last year's overhead costs and direct labor hours, calculate a predetermined overhead rate per direct labor-hour for variable and fixed overhead.

c. Present in T-accounts the full absorption, normal manufacturing cost flows for the three jobs in the first quarter of this year. Use the overhead rates derived in part (b).

d. Prepare income statements for the first quarter of this year under the following costing systems:

(1) Full absorption, actual.

(2) Full absorption, normal.

Step by Step Answer: