Cost-Volume- Profit Analysis: JR Company is considering introducing either of two new products. Each product requires an

Question:

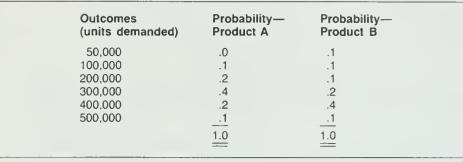

Cost-Volume- Profit Analysis: JR Company is considering introducing either of two new products. Each product requires an increase in annual fixed expenses of $800,000. The products have the same selling price ($20) and the same variable cost per unit ($16). Management, after studying past experience with similar products, has prepared the following subjective probability distribution:

Required:

a. What is the break-even point for each product?

b. Which product should be chosen? Why? Show computations.

c. Revise the data to assume management was absolutely certain that 300,000 units of product B would be sold. Which product should be chosen? Why? What benefits are available to management from the provision of the complete proba- bility distribution instead of just a lone expected value?

Step by Step Answer: