Effect of corporate allocations on segment performance A fishing supplies firm, Badanoff Inc., situated on the shores

Question:

Effect of corporate allocations on segment performance A fishing supplies firm, Badanoff Inc., situated on the shores of Lake Wee B. Gun, manufactures two kinds of downriggers which are used for deep-water trolling. The most expensive product is the Boris, an electric downrigger with automatic depth adjustment, gold-plated electrical connections and built-in rod holders. Because of these desirable features Boris sells for $300 per unit. The other product, Dudley, is a manual downrigger which is clamped on to the gunwales of small boats and sells for $40 per unit. Variable costs of production for Boris are rather high because of the costly raw materials and the high wages paid to the skilled workers. Variable production costs that are directly traceable to the Boris line have been averaging 50% of the sales price. Dudley, on the other hand, is a no-frills model and its variable production costs average 40% of the sales price. These relationships are not expected to change in the near future. Sales commissions are based on sales revenue and established at 20% for Boris and 10% for Dudley. The firm advertises Boris extensively in several media but spends very little on advertising for Dudley. There were no beginning or ending inventories of finished goods for either line during 1991.

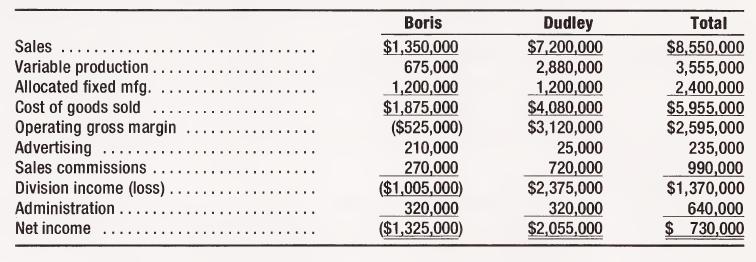

Fixed manufacturing costs include common facility occupancy costs such as depreciation, insurance, property taxes, utilities, etc. In addition, the costs of the maintenance department which services both product lines and factory supervision costs are considered part of the fixed manufacturing costs. The headquarters costs are comprised of the costs associated with top management, the company boat, plane and golf course used for research and development purposes. Also included are costs of support services such as the management information system, the treasurer's staff, the accounting department and headquarters cafeteria. Determining product line performance reports for the two brands is not really difficult as most of the costs are directly traceable to either Boris or Dudley. However, common factory and headquarters costs have been troublesome because these cannot be clearly attributed to activities in either department. Therefore, the chief cost accountant has been dividing those common costs equally among the two product lines. The product line income statement for 1991 follows.

The brand manager for Boris is not satisfied with the performance report shown above. In fact, the manager contends that dividing fixed common costs equally is not logical at all. She argues that her product line comprises a very small percentage of total unit sales and the allocation scheme should reflect that fact.

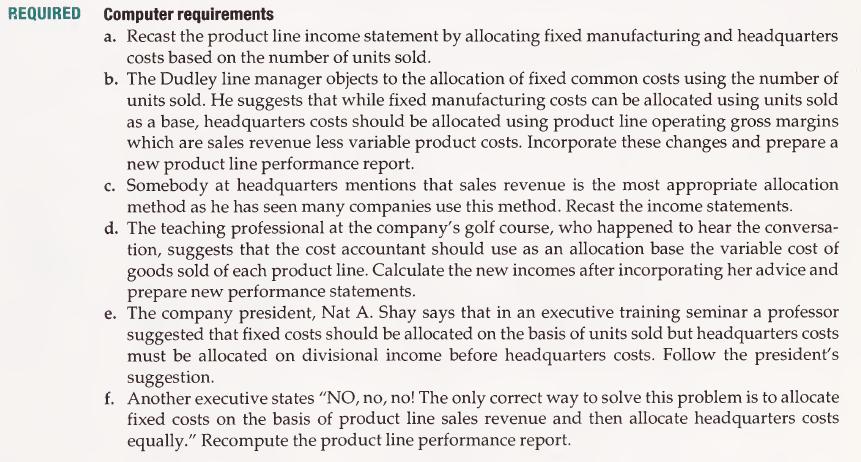

Step by Step Answer: