Impact of costing methods on net income Crocker Company was franchised on January 1, 2008. At the

Question:

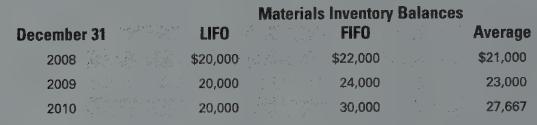

Impact of costing methods on net income Crocker Company was franchised on January 1, 2008. At the end of its third year of operations, December 31, 2010, management requested a study to determine what effect different materials inventory costing methods would have had on its reported net income over the three-year period. The materials inventory account, using LIFO, FIFO, and moving aver- age, would have had the following ending balances:

a. Assuming the same number of units in ending inventory at the end of each year, were material costs rising or falling from 2008 to 2010?

b. Which costing method would show the highest net income for 2008?

Which method would show the highest net income for 2010?

d. Which method would show the lowest net income for the three years combined?

Step by Step Answer: