Information Value (L.O.2): Calvin Hobbes, Inc., is evaluating whether to enter a contract to construct a fleet

Question:

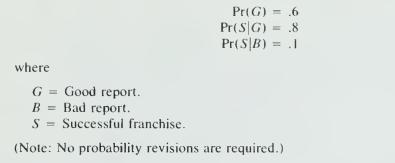

Information Value (L.O.2): Calvin Hobbes, Inc., is evaluating whether to enter a contract to construct a fleet of space vehicles for personal travel. The costs of the franchise and other investments total $200 million. If the product is successful. Calvin Hobbes, Inc., will have a project with a present value of future cash flows of $400 million (that is, before deducting the initial investment cost). If the franchise is not successful, the present value of the future cash inflows will be $80 million. There is a .52 probability that the project will be successful. Tiger International Marketing Corp. offered to conduct a survey for Calvin Hobbes, Inc., which could inform them more precisely whether the franchise would be successful. Tiger International provide the following probabilities for their reports:

Required:

a. What is the maximum price Calvin Hobbes Inc.. would be willing to pay Tiger International to conduct the marketing study?

b. If the probability of a successful project given a good report is .6, what is the maximum price Calvin Hobbes Inc., would be willing to pay Tiger International to conduct the marketing study?

c. If the answers to part

a. and part

b. differ, explain why.

Step by Step Answer: