Interpreting cost of goods manufactured data Warfield Medical Products Company man- ufactures disposable syringes for use in

Question:

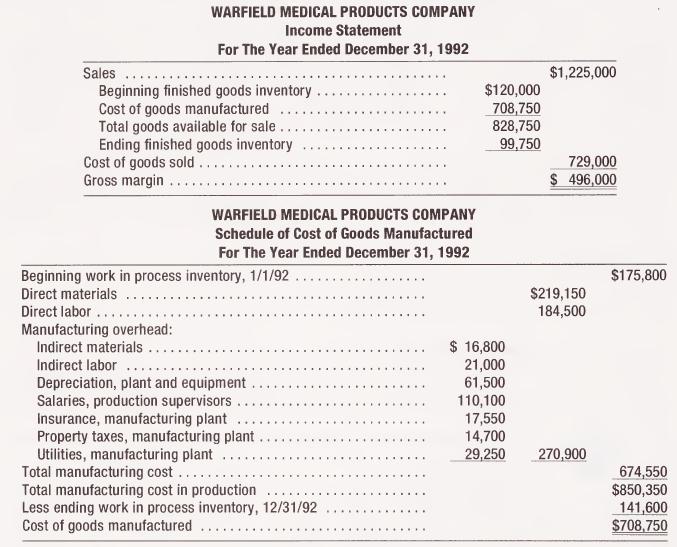

Interpreting cost of goods manufactured data Warfield Medical Products Company man- ufactures disposable syringes for use in medical activities. Most are sold to hospitals and health clinics by the case. One case of syringes contains 24 boxes of syringes each containing one dozen units. During 1992 the company completed and transferred to finished goods 33,750 boxes of syringes, and sold 35,000 boxes. The Raw Materials Inventory account balance on 12/31 /92 was $85,950, and $200,700 of raw materials was purchased during 1992. The Warfield Company uses a FIFO perpetual inventory system. On the next page is the 1992 cost of goods manufactured schedule for the company and the sales and cost of goods sold section of the balance sheet.

REQUIRED

a. Compute the balance in the Raw Materials Inventory account on 1 /1 /92.

b. Compute the amount of change in the Work in Process Inventory account from the beginning of the accounting period to the end.

c. Compute the percentage of current period manufacturing cost that is overhead cost.

d. Compute the average cost per box of syringes manufactured in 1992.

e. Compute the percentage of manufacturing labor that was direct labor.

f. Compute the number of boxes of syringes in ending finished goods inventory on 12/31 /92.

g. Compute the average cost per box of syringes sold during 1992.

h. Compute the average cost per box in finished goods beginning inventory on 1 /1 /92.

i. Compute the company's gross margin percentage for 1992.

j. If the selling price did not change from 1991 to 1992, do you think the gross margin percentage was higher or lower during 1991? Why? What about the total dollar amount of gross margin?

Computer requirement:

k. Assume that a new labor contract will increase labor costs by an average of eight percent, and material costs are expected to increase by five percent. Assume all other factors including production quantities and sales remain the same. Prepare a new schedule of cost of goods manufactured and recompute parts

c, d, and g.

Step by Step Answer: