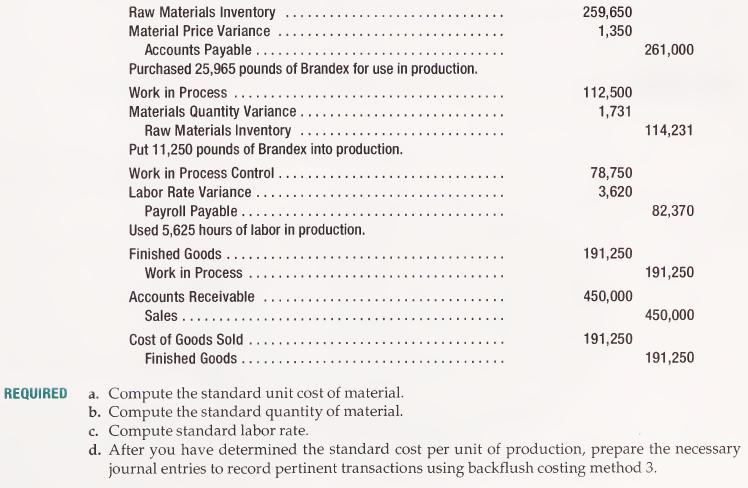

Interpreting variances, backflush method 3 The following journal entries were recorded by Yeshim Berna Company in August:

Question:

Interpreting variances, backflush method 3 The following journal entries were recorded by Yeshim Berna Company in August:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: