Joint cost allocation with costs after split-off and by-product revenue Mega Oil Company transports crude oil to

Question:

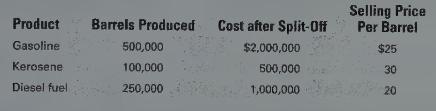

Joint cost allocation with costs after split-off and by-product revenue Mega Oil Company transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and byproduct base oil. The base oil is sold at the split-off point for \(\$ 500,000\) of annual revenue, and the joint processing costs to get the crude oil to split-off are \(\$ 5,000,000\). Additional information includes:

{Required:}

Determine the allocation of joint costs, using the relative sales value method. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: