Net present value of two capital projects Blossen Company produces molded plastic ap- pliance housings. Its molds

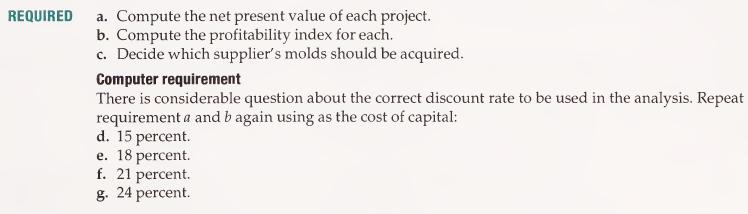

Question:

Net present value of two capital projects Blossen Company produces molded plastic ap- pliance housings. Its molds are wearing out and need replacing. The company is evaluating two suppliers' proposals for replacement molds. Supplier A is offering to replace the company's molds with new molds costing $305,000. The supplier will allow $15,000 on the company's old molds as a trade-in. The new molds have a useful life of 5 years and a salvage value of $10,000. Using the new molds, the company estimates net cash inflows of $95,000 per year.

Supplier B is offering replacement molds costing $330,000 and is willing to allow $10,000 as a trade-in on the old molds. The new molds have a useful life of 7 years and a salvage value of $10,000. Since these molds require more maintenance than those of supplier A, the company estimates that its net cash inflows from using the molds would be only $90,000 per year. The company evaluates its capital projects using the net present value method with an estimated cost of capital of 20 percent.

Step by Step Answer: