New Product IntroductionCVP Considerations: Servo Gimmicks, Ltd., produces and sells new and unusual household products. The company

Question:

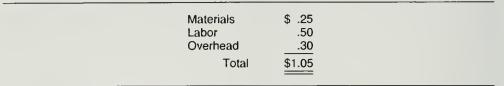

New Product Introduction—CVP Considerations: Servo Gimmicks, Ltd., produces and sells new and unusual household products. The company recently received a proposal to manufacture a left-handed bottle opener. The product engineering department estimates variable manufacturing costs for each unit of:

Variable selling costs include $.55 for packaging and shipping. In addition. Servo allocates $.10 of common fixed costs to each unit sold. If Servo decides to sell the product, they will launch a media campaign on late-night television. The media campaign will cost $450,000. Of course. Servo has a number of products, and if they don't produce the left-handed bottle opener, they will manufacture some other item. Servo estimates that any product they sell must contribute at least $500,000 to aftertax profits. The marketing department estimates that the optimal selling price for the product is $3.99.

Required: If Servo's tax rate is 45 percent, how many left-handed bottle openers must be sold to meet the profit target? Show computations in good form.

Step by Step Answer: