Payback and discounted cash flow analysis Mr. and Mrs. Booble are looking for some income property in

Question:

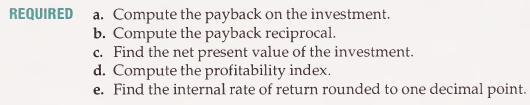

Payback and discounted cash flow analysis Mr. and Mrs. Booble are looking for some income property in which to invest their savings. They have located a duplex that is rented for $19,000 per year. The asking price is $85,000. Their lawyer has agreed to handle the legal expenses for 4 percent of the asking price. Various fees and other closing costs to purchase the property are estimated at $2,600. The owner of the property has provided figures which indicate that annual maintenance for the property is $2,300 and property taxes are $1,400 per year. In addition, $300 of miscellaneous expenses are usually incurred each year. The property has a useful life of 25 years and the buyers plan to use straight-line depreciation. They have decided that they must have a return of at least 14 percent on their investment.

Step by Step Answer: