Payback, NPV, PI, and IRR analysis Hillandale Golf course employs five people to mow its fairways with

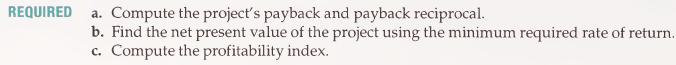

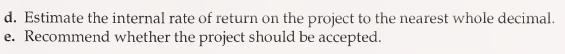

Question:

Payback, NPV, PI, and IRR analysis Hillandale Golf course employs five people to mow its fairways with rotary 48 inch mowers. New gang-type reel mowers that cut an 8-foot width cost $98,500 and have a 10-year life and a $12,000 salvage value. One of the workers is retiring and if the new mowers are acquired he would not be replaced. Another person could be shifted to a golf-cart maintenance job that was left vacant when a maintenance employee recently quit. Consequently, buying the new mowers could save $26,000 per year in personnel salaries. However, maintenance cost on the new mowers would be $5,500 per year higher than on the old ones. The old mowers can be sold for $7,000.

The golf course manager, Gloria Green, is reluctant to invest almost $100,000 in new equipment. She is afraid that the golf course may be unable to maintain the 16 percent minimum required return if the money is spent. "If the payback is more than four years I would not recommend the investment," she tells the board of directors. But she agrees to have an analysis performed and obtain a recommendation from the analyst.

Step by Step Answer: