Present Value of Cash Flows under Inflation: A company has concluded that its cost of capital is

Question:

Present Value of Cash Flows under Inflation: A company has concluded that its cost of capital is 8 percent in real terms. The company is considering an investment in a project having annual cash flows (before taxes and inflation) of $36,000 per year for five years. At disinvestment, the costs of disposal will equal any liquidation value of the project. No additional working capital is required for the project. The project costs $120,000 and will be depreciated for tax purposes over five years as follows: Year I, 15 percent of the cost; Year 2, 22 percent; and 21 percent per year in each of Years 3-5. The company's marginal tax rate is 40 percent.

Required:

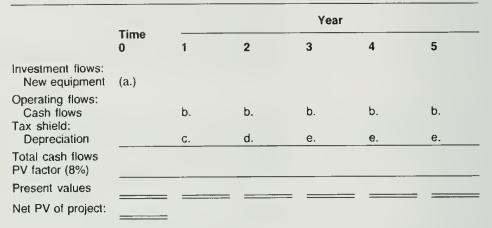

a. Assuming no inflation, complete the table below to compute the net present value of this project.

b. If inflation is expected to be 12 percent, what is the present value of the project? Refer to Illustration 15-11 for present value tables under inflation. (Hint: Inflation affects both cash flows and the nominal rate of interest.)

Step by Step Answer: