Present Value of Tax Shield: A company plans to acquire an asset at a cost of $750,000

Question:

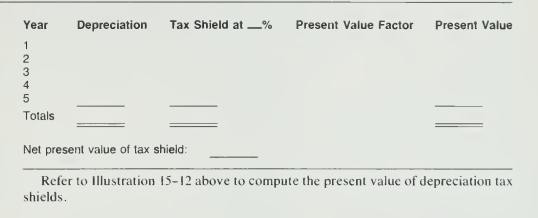

Present Value of Tax Shield: A company plans to acquire an asset at a cost of $750,000 that will be depreciated for tax purposes as follows: Year 1, $210.000; Year 2. $300,000; and $80,000 per year in each of Years 3-5. A 15 percent discount rate is appropriate for this asset, and the company's tax rate is 35 percent.

Required: Compute the present value of the tax shield. Refer to Illustration 15-12 for format.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: