Processing payroll records: comprehensive problem. Juvenile Playskills, Inc., manufactures toys. Since the last day of the normal

Question:

Processing payroll records: comprehensive problem. Juvenile Playskills, Inc., manufactures toys. Since the last day of the normal payroll period falls on September 30, there are no accrued wages payable and no analysis of time tickets for a partial pay period. The following reports have been prepared:

Instructions NOTE: If you are using the Study Guide and Working Papers, the beginning data from Instructions 1-5 and 8a and 8b have already been recorded for you.

1. Set up the following job cost sheets:

Job 479, Delta Department Store, 200 units, started Sept. 10 Job 480, Educational Toys, 300 units, started Sept. 18 Job 481, Peter Pan Toy Store, 350 units, started Sept. 22 Job 482, O’Malley’s Specialty Store, 200 units, started Sept. 25 Job 483, Ramirez Toy Shop, 150 units, started Sept. 27 2. Set up the following departmental overhead analysis sheets:

Molding Department Building Services Department Assembling Department General Factory Department Painting Department 3.

a. Set up the following general ledger accounts:

Work in Process 122 FICA Taxes Payable 211 Federal Unemployment Taxes Payable 212 State Unemployment Taxes Payable 213 Factory Payroll Clearing 500 (Enter the September 1 credit balance of $8,930.)

Manufacturing Overhead Control 501

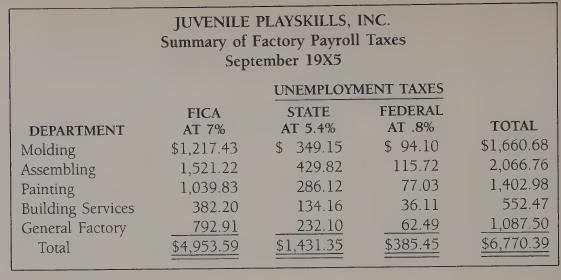

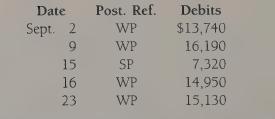

b. Record the following debits in the Factory Payroll Clearing account. Compute the balances.

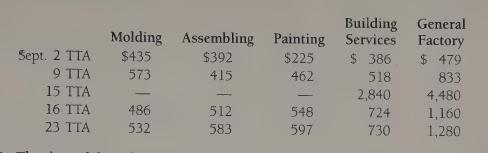

4. Indirect labor charges for the weeks ended September 2, 9, 16, and 23 are given below. Post these charges by week to the departmental overhead analysis sheets set up in Instruction 2.

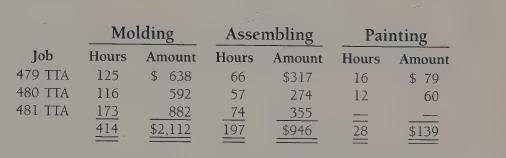

5. The direct labor charges below have been taken from the analysis of time tickets for the week ended September 23. Post the data to the job cost sheets set up in Instruction 1.

6.

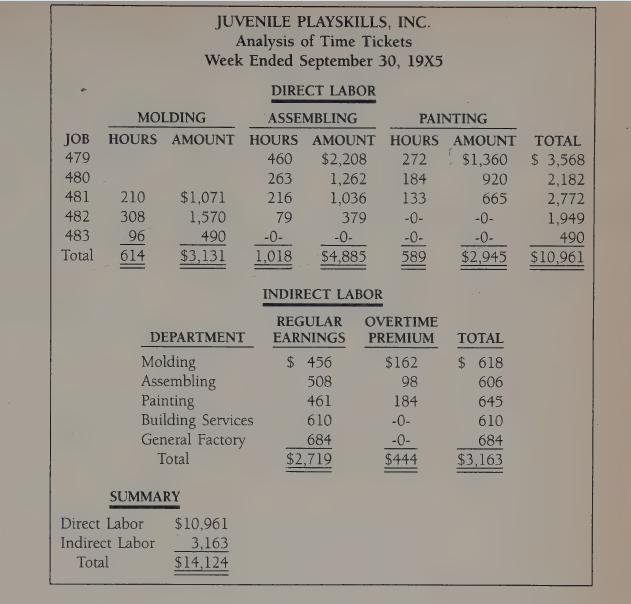

a. Post the data from the analysis of time tickets for the week ended September 30, 19X5, to the job cost sheets set up in Instruction 1 and the departmental overhead analysis sheets set up in Instruction 2.

b. Post the total amount of this weekly payroll directly as a debit to Factory Payroll Clearing 500 set up in Instruction 3. Omit posting the credit side of the entry.

7.

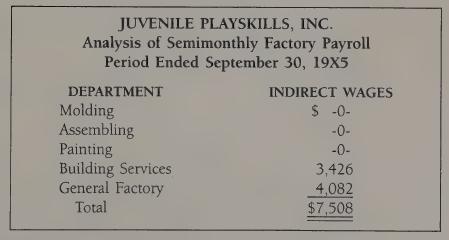

a. Post the amounts from the analysis of semimonthly factory payroll for the period ended September 30, 19X5, to the departmental overhead analysis sheets set up in Instruction 2.

b. Post the total amount of this semimonthly payroll directly as a debit to Factory Payroll Clearing 500. Omit posting the credit side of the entry.

8. Prepare the summary of factory wages for the month of September.

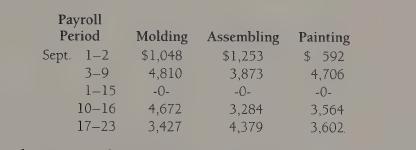

a. Enter in the appropriate columns the following departmental direct labor charges for each payroll period:

b. Enter in the appropriate columns the departmental indirect labor charges from the data given in Instruction 4.

c. Enter the departmental direct labor charges from the analysis of time tickets for the week ended September 30.

d. Enter the departmental indirect labor charges from the analysis of time tick- ets for the week ended September 30.

e. Enter the departmental indirect labor charges from the analysis of semi- monthly factory payroll for the period ended September 30, 19X5.

f. Total all columns, crossfoot to prove, and double rule. Prepare the Summary section.

9.

a. Prepare a general journal voucher to transfer all direct and indirect labor costs for the month to production. (Voucher 9-33.)

b. Post this journal voucher to the general ledger accounts.

10. Post the amounts from the summary of factory payroll taxes (use the reference SPT) to the departmental overhead analysis sheets set up in Instruction 2.

11.

a. Prepare the general journal voucher to record payroll taxes payable. (Voucher 9-34.)

b. Post this journal voucher to the general ledger accounts.

12. Foot all hour and amount columns of the job cost sheets and summarize the data in a schedule showing the totals for each job by department.

13. Foot the amount columns of the departmental overhead analysis sheets and summarize the data in a schedule showing the total for each department by type of cost.

14. Check the extensions of the general ledger account balances, and prepare a schedule showing the name and number of each account, the balance, and whether the balance is a debit or credit.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock