The Shop at Home Company is a mail-order house. During the year it sends catalogs to several

Question:

The Shop at Home Company is a mail-order house. During the year it sends catalogs to several hundred thousand customers who order the company’s specialty products by mail. The Shop at Home Company pays postage or freight on all products sold. Customers may either send a cash payment (by personal check)

with their orders (in which case they are entitled to take a discount of 4 percent on the sales price), or they may purchase on open account. Approximately 50 percent of all orders are accompanied by a cash payment.

The company’s profits have declined in recent years. The controller argues that one reason for the decrease in profits is that there has been a large growth in the number of customers ordering small quantities of merchandise. Over 20,000 orders of less than $10 each have been received in each of the past two years. These small orders represent about 20 percent of the total number of invoices for the year and about 8 percent of the total dollar volume of sales. The controller has suggested that one of three steps be taken.

a. Accept no order for less than $10.

b. Add a handling charge of $1 to all orders for less than $10.

c. Require a cash payment on all orders and eliminate the discount for cash payments.

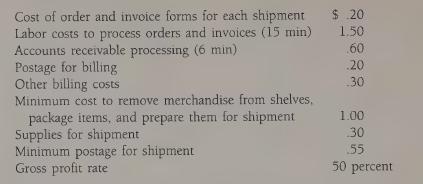

The controller also submitted the following information, on which he based his recommendations:

1. Assuming that 20,000 small orders are involved and that the average of each order is $8, estimate the effect on the firm’s profit of each of the controller’s suggested courses of action. (Make your estimates as accurate as you can from the available information.)

2. What other factors must be considered in making a decision?

3. What is your recommended course of action? Why?

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock