The Urban Corporation has three divisions, A, B, and C. Division A produces parts used in the

Question:

The Urban Corporation has three divisions, A, B, and C. Division A produces parts used in the subassembly manufactured by Division B. There is no intermediate market for these parts. The subassembly produced in Division B is used in the final product produced by Division malic market price for the subassembly is $35 per unit.

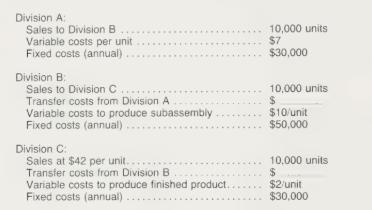

Transfer prices between Divisions A and B are calculated using the full cost method. Transfer prices between Divisions B and C are calculated using the full cost plus 20% method. Pertinent information for the divisions is as follows:pg58

Required:

a Calculate the gross profit of each division using the transfer price methods utilized ty the corporation.

b Suppose the cost plus method used between Divisions B and C has not fairly represented the potential market price of the subassembly. The manager of Division B insists on transferring at the market price of the subassembly. But the manager of Division C refuses because transferring at market price would have a huge adverse effect on the division’s performance evaluation. So after 2 weeks of intensive negotiating, a transfer price of $32.50 per unit was agreed upon.

Calculate the gross profit of each division using the new transfer price.

c Assume all three divisions are evaluated the same way; that is, the gross profit of each division is used as a basis for performance evaluation. Does this seem fair to Division A? If not, give some possible solutions.

Step by Step Answer:

Cost Accounting Concepts And Applications For Managerial Decision Making

ISBN: 9780070103108

2nd Edition

Authors: Ralph S. Polimeni, James A. Cashin, Frank J. Fabozzi, Arthur H. Adelberg