Woodside Products, Inc.3 (Profit Variance Analysis): Phil Brooks, president of Woodside Products. Inc., called Marilyn Mynar into

Question:

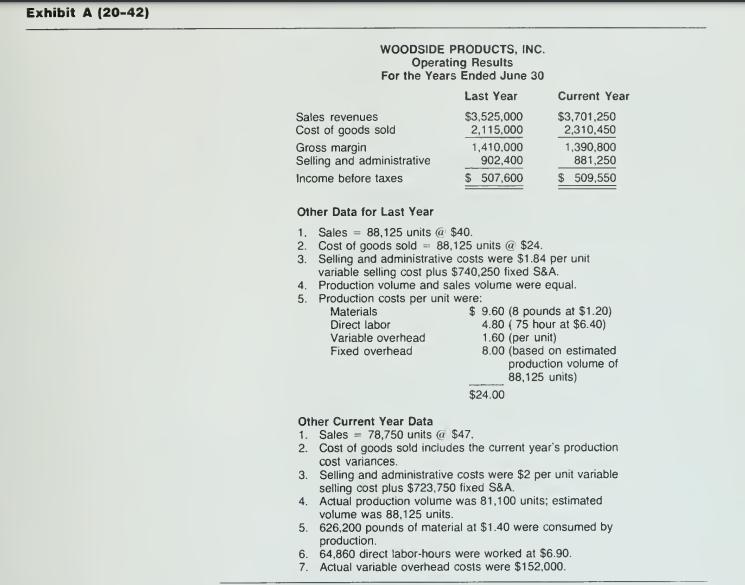

Woodside Products, Inc.3 (Profit Variance Analysis): Phil Brooks, president of Woodside Products. Inc., called Marilyn Mynar into his office one morning in early July. Ms. Mynar was a business major in college and was employed by Woodside during her college summer vacation. "Marilyn," Brooks began, "I've just received the preliminary financial state- ments for our current fiscal year, which ended June 30. Both our board of directors and our shareholders will want, and deserve, an explanation of why our pretax income was virtually unchanged even though revenues were up by more than $175,000. The accountant is tied up working with our outside CPA on the annual audit, so I thought you could do the necessary analysis. What I'd like is as much of a detailed explanation of the $1,950 profit increase as you can glean from these data (Exhibit A). Also, draft a statement for the next board meeting that explains the same $1,950 profit increase. Since the board of directors understands variable costing, I recommend that you convert everything to variable costing for the variance computations, then reconcile your variable costing numbers with the amounts shown in Exhibit A, if necessary."

Required: Prepare the detailed analysis of the $1.950 profit increase from last fiscal year to the current fiscal year and draft an explanation for Woodside's board of directors, as requested by Phil Brooks. (Hint: Let last year's amounts be budgets or standards.) Assume that finished goods inventory was valued at $24 per unit (using full-absorp- tion costing) at the end of this year.

Step by Step Answer: