Calculation of traditional and ABC product costs The Gadget Co produces three products, A, B and C,

Question:

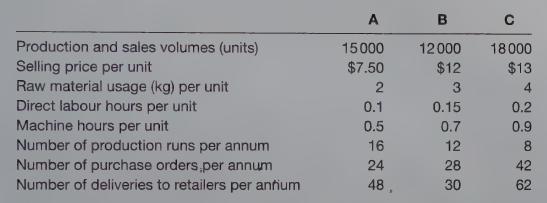

Calculation of traditional and ABC product costs The Gadget Co produces three products, A, B and C, all made from the same material. Until now, it has used traditional absorption costing to allocate overheads to its products. The company is now considering an activity-based costing system in the hope that it will improve profitability. Information for the three products for the last year is as follows:

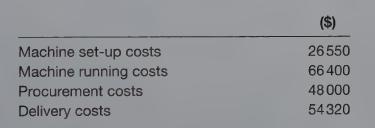

The price for raw materials remained constant throughout the year at $1.20 per kg. Similarly, the direct labour cost for the whole workforce was $14.80 per hour. The annual overhead costs were as follows:

Required:

(a) Calculate the full cost per unit for products A, B and C under traditional absorption costing, using direct labour hours as the basis for apportionment.

(5 marks)

(b) Calculate the full cost per unit of each product using activity-based costing.

(9 marks)

(c) Using your calculation from

(a) and

(b) above, explain how activity-based costing may help The Gadget Co improve the profitability of each product.

(6 marks)

ACCA F5 Performance Management

Step by Step Answer: