Direct labour budget and labour cost accounting A company, which manufactures a range of consumer products, is

Question:

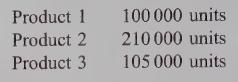

Direct labour budget and labour cost accounting A company, which manufactures a range of consumer products, is preparing the direct labour budget for one of its factories. Three products are manufactured in the factory. Each product passes through two stages: filling and packing.

Direct labour efficiency standards are set for each stage. The standards are based upon the number of units expected to be manufactured per hour of direct labour. Current standards are:

Stocks at the beginning of the budget year are expected to be:

After completion of the filling stage, 5% of the output of Products 1 and 3 is expected to be rejected and destroyed. The cost of such rejects is treated as a normal loss.

A single direct labour hour rate is established for the factory as a whole. The total payroll cost of direct labour personnel is included in the direct labour rate. Hours of direct labour personnel are budgeted to be split as follows:

All direct labour personnel are employed on a fulltime basis to work a basic 35 hour, 5 day, week.

Overtime is to be budgeted at an average of 3 hours per employee, per week. Overtime is paid at a premium of 25% over the basic hourly rate of £4 per hour. There will be 250 possible working days during the year. You are to assume that employees are paid for exactly 52 weeks in the year.

Required:

Calculate:

(a) The number of full-time direct employees required during the budget year. (/4 marks)

(b) The direct labour rate (£ per hour, to 2 decimal places). (5 marks)

(c) The direct labour cost for each product (pence per unit to 2 decimal places).

Step by Step Answer: