Payback and NPV calculations A company is trying to decide which of two investment projects it should

Question:

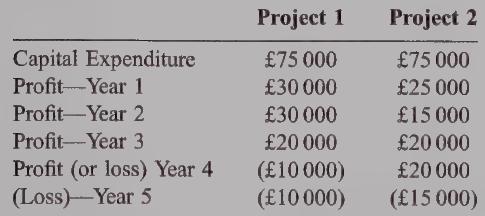

Payback and NPV calculations A company is trying to decide which of two investment projects it should choose. The following information is provided:

1. Each product is expected to be operational for five years, at the end of which time there is not expected to be any scrap value.

2. Capital expenditure for both projects would be incurred immediately.

3. The profit figures are shown after including depreciation on a straight-line basis.

4. Taxation is to be ignored.

5. The company’s cost of capital is 15%.

Required:

(a) Calculate for each project:

(i) the payback period in years to one decimal place;

(ii) The net present value. (16 marks)

(b) State the relative merits of the methods of evaluation mentioned in

(a) above.

(6 marks)

(c) Explain which project you would recommend for acceptance. (3 marks)

AAT Cost Accounting and Budgeting

Step by Step Answer: