Preparation of cash budgets A redundant manager who received compensation of 80000 decides to commence business on

Question:

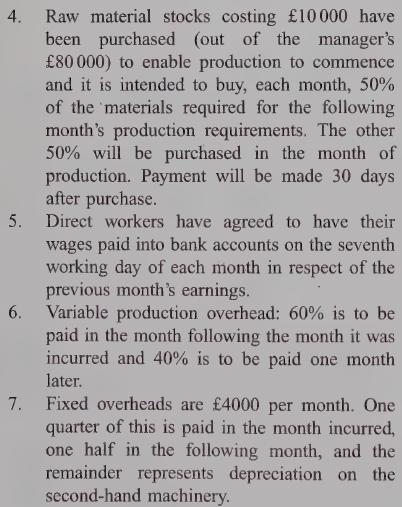

Preparation of cash budgets A redundant manager who received compensation of £80000 decides to commence business on 4 January, manufacturing a product for which he knows there is a ready market. He intends to employ some of his former workers who were also made redundant but they will not all commence on 4 January. Suitable premises have been found to rent and second-hand machinery costing £60000 has been bought out of the

£80000. This machinery has an estimated life of five years from January and no residual value.

Other data & Production will begin on 4 January and 25%

of the following month’s sales will be manufactured in January. Each month thereafter the production will consist of 75% of the current month’s sales and 25% of the following month’s sales.

received in the following month, 20% in the third month and 8% in the fourth month. The balance of 2% represents anticipated bad debts.

You are required to:

(a) (i) prepare a cash budget for each of the first four months, assuming that overdraft facilities will be available; (/7 marks)

(ii) state the amount receivable from customers in May; (4 marks)

(b) describe briefly the benefits to cash budgeting from the use of a particular type of software package.

Step by Step Answer: