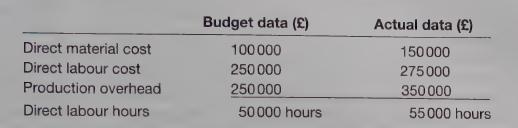

Various overhead absorption rates and under- over-recovery The following data relate to a manufacturing department for a

Question:

Various overhead absorption rates and under- over-recovery The following data relate to a manufacturing department for a period:

Job ZX was one of the jobs worked on during the period. Direct material costing £7000 and direct labour (800 hours) costing £4000 were incurred.

Required:

(i) Calculate the production overhead absorption rate predetermined for the period based on:

(a) percentage of direct material cost;

(b) direct labour hours.

(3 marks)

(ii) Calculate the productidn overhead cost to be charged to Job ZX based on the rates calculated in answer to (i) above.

(2 marks)

(iii) Assume that the direct labour hour rate of absorption is used. Calculate the under- or over-absorption of production overheads for the period and state an appropriate treatment in the accounts.

(4 marks)

(iv) Comment briefly on the relative merits of the two methods of overhead absorption used in (i) above.

(6 marks)

AAT Cost Accounting and Budgeting

Step by Step Answer: