In 19X4, the Polymer Products Company was a multinational company engaged in themanufacture of a widely diverse

Question:

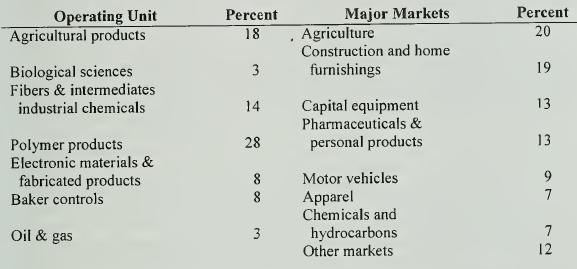

In 19X4, the Polymer Products Company was a multinational company engaged in themanufacture of a widely diverse line of products including chemical and agricultural products, man-made fibers, electronic materials, health care, process controls, fabricated products, and oil and gas. Sales in 19X4 were $6.7 billion with the following breakdown as to operating units and major markets:

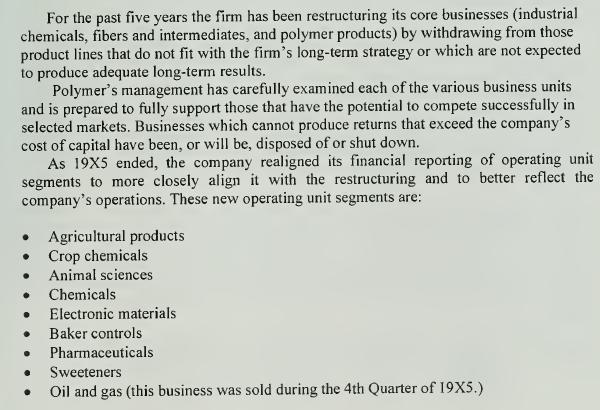

Fibers and intermediates, industrial chemicals, polymer products, and a portion of fabricated products have been combined to form a new segment—chemicals. Two new segments, pharmaceuticals and sweeteners, include the acquired operations of a pharmaceutical company. The electronics business has been made a separate segment and the separations business, previously part of fabricated products, has been transferred to and combined with Baker controls, serving similar process control equipment markets.

The former biological sciences segment has been eliminated and their animal nutrition products are now part of animal sciences. The health care division was merged with the acquired company and is included in the pharmaceuticals segment.

Company Performance Measurement Philosophy Up until the start of the decade. Polymer focused on a performance income measure of an operating unit's performance; assigning only the directly controllable elements of sales, cost of goods sold, marketing, administrative, technical expenses, inventory, and receivables to the operating units for internal reporting purposes. Non-directly controllable elements, such as corporate staff support groups, interest expense/interest income and foreign currency gains and losses were pooled corporately and various formulae were used to assign these corporate charges to operating units for determining a pro-forma net income, return on investment, and cash flow. Such overall indicators of performance were thus only directionally representative at the operating unit level.

As some of the company's core businesses matured and declined, an awareness began to emerge of the need to shift business strategies thus requiring tougher decisions as to divestment/investment/acquisition activities. Top management recognized the need for more accurate measurement and understanding of worldwide operating unit results.

For example, currency gains and losses were treated as a component of corporate charges. Thus, if a U.S. produced product were sold to a French customer on 180-day terms, the selling business unit reflected the full sales value at the then current exchange rate; leaving the company exposed to devaluation of the French franc. If devaluation occurred, performance of the operating unit was not affected but the company results were.

As another example, all operating units applied an average worldwide tax rate to compute a pro-forma net income, return on capital, and cash flow. When an operating unit had a choice to source the same product from Belgium or the U.K., a dilemma was created. Although costs were nominally higher in the U.K., lowering a unit's performance income, the company was in a non-tax position there which drastically improved real net income. However, by reporting results using an average worldwide tax rate, all product sourcing from the U.K. appeared disadvantageous. Also, the company was not taking advantage of an entity's tax loss carry-forward situation in various pricing and sourcing decisions.

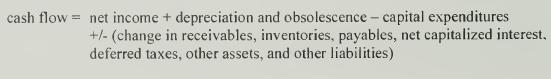

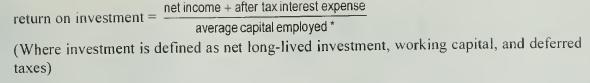

Top management wanted a reporting and performance measurement system which brought operating unit management's' attention to all the financial impacts of a business decision. To accomplish this, it was decided in 19X2 that as many of the income statement and balance sheet items as was practicable would be identified with each operating unit and charged out accordingly. Each operating unit would then be measured by the achievement against goals established for return on investment and cash flow as defined below.

The incentive compensation system employed for upper management positions is essentially based upon the relative success in achieving annual budgets established for the above measures. The total corporate annual incentive award is determined somewhat rigidly, based upon where earnings fall within a budget range determined at the beginning of each year. The award is apportioned to cascade down the organization. Thus a similar quantitative assessment of results is made to reward or penalize managers for their ultimate contribution to results. The incentive awards are then presented 2/3 in cash and 1/3 in restricted stock which is accessible only after 3 years and only if stock prices meet certain appreciation tests. This latter feature was recently employed to add a long-term dimension to the program in addition to near-term annual income/cash flow results.

Prior to the new reporting and measurement scheme (called asset management) the amount of corporately pooled costs allocated as a corporate charge was over 3 percent of worldwide sales. After the asset management program was instituted, along with selected decentralization of certain corporate staff groups, these corporately pooled costs were less than 2 percent of worldwide sales.

Required:

1 What type of performance measurement system did Polymer Products use prior to the recent change?

2. What type of performance measurement system is Polymer Products using now?

Why did Polymer Products move to this new system? How does the change affect the firm's global competitiveness?

3. In the new performance measurement system, should managers be held responsible for foreign currency exchange gains and losses and income taxes. (

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin