I've been hearing a lot lately about something called EVA, which stands for Economic Value Added, and

Question:

I've been hearing a lot lately about something "called EVA, which stands for Economic Value Added, and I was curious whether it is something we can use at OSI," Keith Martin said as he finished his lunch. Keith is presidem and CEO of OutSource, Inc. His guest for lunch that day was a computer industry analyst from a local brokerage firm. Keith had invited him to lunch so he could get more information on EVA and its uses.

"Yes," the analyst replied, "I've heard a great deal about EVA. It's a residual income approach in which a firm's net operating profit after taxes—called NOPAT—is reduced by a minimum level of return a firm must earn on the total amount of capital placed at its disposal. . xi^nA-r

"Have you seen the recem articles on EVA? The after-tax operating profit, NOPAl as vou called it, and the amount used for capital don't come directly off the financial statements. You have to analyze the footnotes to determine the adjustments that have to be made to come up with those amounts."

"The article sounds like interesting reading for me, especially at this point," Keith said. "Can you send me a copy?"

"Sure," said the analyst. "But tell me, what is it about EVA that piqued your interest in trying it at OSI?"

"In tracking our industry," Keith replied, "I see the stock prices of some ot our key competitors, like Equifax, increasing. Yet, when I compare OSI's recent growth in sales and earnings, our return on equity and earnings per share compare well to those firms, but our stock price doesn't achieve nearly the same rate of increase, and I don't understand why."

The analyst suggested, "Some of those firms might be benefiting from using EVA already and the market value of their stock probably reflects the results of their efforts. It has been shown that a higher level of correlation exists between EVA and a stock's market value than has been found with the traditional accounting performance measures like ROE or EPS."

"But will EVA work in a small service firm like OSI?"

But I've read about EVA being used at smaller firms," said the analyst. "I'm not an expert on EVA, but I don't see any reason why it wouldn't work at OSI."

"I'd like to find out more about EVA and how we can use it at OSI. For example, we've talked about a new incentive plan-will EVA work in that area? And, if so, will it help us in deciding how we should organize and manage our operations as we expand and grow? What can you do to get more information on these things to me?"

COMPANY INFORMATION Outsource Inc. (OSI) is a computer service bureau that provides basic data processing and general business support services to a number of business firms, including several large firms in the immediate local area. Its offices are in a large city in the mid-Atlantic region and it serves client firms in several Mid-Atlamic States. OSI's revenues have grown'rapidly in recent years as businesses have downsized and outsourced many of their basic support services. The Corplnfo Data Service (CIDS) classifies OSI as an Information Services firm

(SIC 7374). This group is composed, in large part, of smaller, independent entrepreneurs that provide a variety of often disparate services to both corporate and government clients.

Market analysts feel a continuously healthy economy translates into strong potential for higher earnings by members of this group. A factor sustaining an extended period of growth is the increased attention of firms to control costs and to outsource their non-core functions, such as personnel placement, payroll, human resources, insurance, and data processing. This trend is expected to continue, probably at an increasing rate. Several firms in this industry have capitalized on their growth and geographic expansion to win lucrative contracts with large clients that previously had been awarded on a market-bymarket basis.

Although OSI operates out of its own facilities, which include some computing equipment and furniture, the bulk of its computer processing power is obtained from excess computer capacity in the local area, primarily rented time during third-shift operations at a large local bank. To be successful in the long term, however, OSI management knows it must expand its business considerably, and, to ensure it has full control over its operations, it must set up its own large-scale computing facility in-house. These items are included in OSI's strategic plan.

As OSI's reputation for accurate, reliable, and quick response service has spread, the firm has found new business coming its way in a variety of data processing and support services. The issue has been deciding which services to take on or to stay out of in light of the current limitations on OSI's computing resources and assurance it can continue to provide high-quality service to its customers. Things definitely are looking up for OSI, and industry market analysts recently have begun to look more favorably on its stock.

In 19X3, OSI's board decided to pursue additional opportunities in payroll processing and tax filing services, and OSI purchased a medium-sized firm that had an established market providing payroll calculations, processing, and reporting services for several Fortune 500 firms on the East Coast. Now OSI is in the midst of developing a new payroll processing system, called PayNet, to replace the outmoded system that was originally created by the firm it acquired.

Once PayNet is developed, it will give users an integrated payroll solution with a simpler, more familiar graphic user interface. From an administrative perspective, it will allow OSI to reduce its manual data entry hiring, to speed data compilation and analysis, and to simplify administrative tasks and the updating of customer files for adds, moves, and changes. PayNet will serve as the backbone for OSI's service bureau payroll processing operations in the future, but developmental and programming costs have been higher than expected and will delay the roll out of the final version of the new payroll pro'gram. Beta testing of the production version of PayNet is being delayed from the second to the third quarter of 19X6.

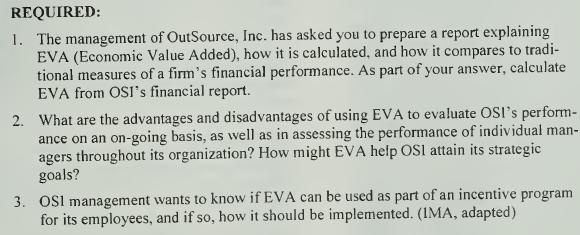

ADDITIONAL ACCOUNTING INFORMATION OSI's financial statements for 19X5 appear in T-1. The following list of information is pertinent to calculating a firm's EVA extracted from the footnotes to OSI's annual report for 19X5.

A. Inventories are stated principally at cost (last-in, first-out), which is not in excess of market. Replacement cost would be $2,796 greater than the 19X4 inventory balance and $3,613 greater than the 19X5 inventory balance.

B. On July 1, 19X3, the company acquired CompuPay, a payroll processing and reporting service firm. The acquisition was accounted for as a purchase, and the excess cost over the fair value of net assets acquired was $109,200, which is being amortized on a straight-line basis over 13 years. One-half year of goodwill amortization was recorded in 19X3.

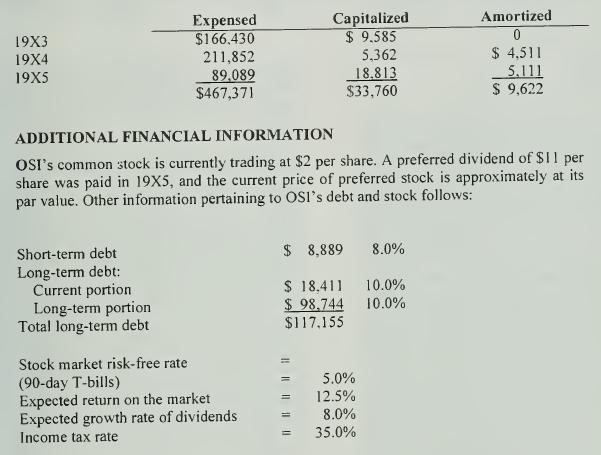

C. Research and development costs related to software development are expensed as incurred. Software development costs are capitalized from the point in time when the technological feasibility of a piece of software has been determined until it is ready to be put on line to process customer data. The cost of purchased software, which is ready for service, is capitalized on acquisition. Software development costs and purchased software costs are amortized using the straight-line method over periods ranging from three to seven years. A history of the accounting treatment of software development costs and purchased software costs follow;

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin