MACRS (CMA adapted) Beloit Company manufacturers motorized utility equipment and trucks. Beloit's Assembly Department employs about 200

Question:

MACRS (CMA adapted) Beloit Company manufacturers motorized utility equipment and trucks. Beloit's Assembly Department employs about 200 workers who are covered by a labor contract that will expire on December 31 , 19x5. During negotiations with Beloit for a new contract, the union has presented a proposal covering the next four years (19x6-x9).

This proposal calls for an increase in wage rates of $2.00 per hour at the beginning of 19x6 and an additional $1.00 per hour at the beginning of 19x8. Employee benefits will be 40 percent of regular wages (total wages exclusive of any overtime premium) under the terms of the union proposal. Management is concemed that the increase in labor costs will eliminate most of its profits.

Beloit's long-range plans call for expansion of the product line in the near future.

Management is working with outside consultants on the design of a new automated plant that will double present capacity. The new plant is to be operational in January 20x0, at which time the existing facility will be sold.

The assembly activity in the new plant will be highly automated. Now, in response to the union proposal, management wants to examine the possibility of automating the existing Assembly Department. Because the system has already been designed and developed, the vice-president of Production is confident that the equipment could be acquired and installed in late 19x5 to be operational in January 19x6.

The Controller has been asked to provide an economic analysis of the proposal to automate the existing Assembly Department based on the labor costs included in the union proposal. The Controller has accumulated the following data.

• The sales revenues for the next four years are expected to be relatively stable.

• Production volume is unifomi throughout the year. Currently, a total of 40,000 labor hours is worked annually in the Assembly Department, of which 3,000 labor hours are subject to an overtime premium of 50 percent of the wage rate.

• The wage rate under the current labor contract is $20 per hour.

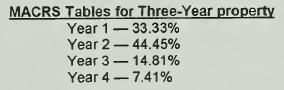

• The new equipment will be purchased and installed in the Assembly Department in December 19x5 at a cost of $3,000,000. The company will claim the four percent reduced investment tax credit in the year the equipment is placed in service; there is no reduction in asset basis when the reduced investment tax credit is claimed. For financial reporting, the equipment will be depreciated using the straight-line method over the four-year life. For tax Purposes, this is three-year equipment and will be depreciated using the MACRS personal property rates presented below.

• The labor hours worked in the Assembly Department will be reduced to 15,000 annually with the new equipment, and because of increased efficiency, overtime will be eliminated.

• Annual maintenance costs will increase by $12,000 with the new equipment.

• The existing facility can be sold for $1,600,000 at December 31, 19x9. However, if the Assembly Department is automated, the plant can then be sold for $2,000,000.

The basis for tax purposes of the existing facility on December 31 , 19x9, exclusive of the new equipment, will be $1 ,400,000, whether or not the Assembly Department is automated.

• Beloit Company is subject to a 40 percent income tax rate of ail income.

• Management assumes annual cash flows occur at the end of the year for evaluating capital investment proposals. The company uses a 15 percent after-tax discount rate.

REQUIRED:

Based on the labor costs included in the union proposal, calculate the net present value at December 31, 19x5, of Beloit Company's proposal to automate the Assembly Department

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin