Refer to Exhibit 12.4 in the text. What is the depreciation expense deduction in each of 4

Question:

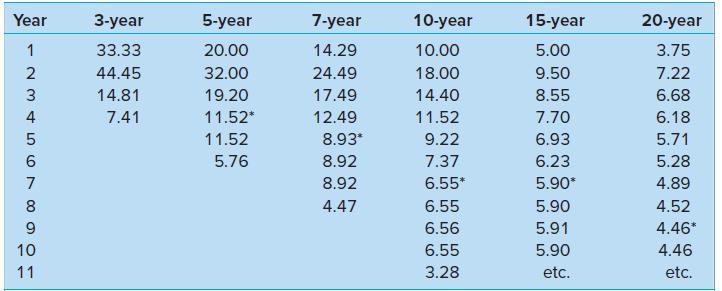

Refer to Exhibit 12.4 in the text. What is the depreciation expense deduction in each of 4 years for a $10,000 asset classified under MACRS as 3-year property?

Exhibit 12.4

Transcribed Image Text:

Year 3-year 5-year 7-year 10-year 15-year 20-year 1 33.33 20.00 14.29 10.00 5.00 3.75 2 44.45 32.00 24.49 18.00 9.50 7.22 14.81 19.20 17.49 14.40 8.55 6.68 4 7.41 11.52* 12.49 11.52 7.70 6.18 5 11.52 8.93* 9.22 6.93 5.71 5.76 8.92 7.37 6.23 5.28 7 8.92 6.55* 5.90* 4.89 8. 4.47 6.55 5.90 4.52 6.56 5.91 4.46* 10 6.55 5.90 4.46 11 3.28 etc. etc.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (19 reviews)

Depreciation is a charge calculated on the value of fixed assets ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

1. What is the depreciation expense using the straight line method on a asset costing 10,000 if it has a useful life of 4 years and a salvage value of 2,000? a. 2,500 b. 2,000 c. 5,000 2. If an asset...

-

For an asset that fits into the MACRS "All property not assigned to another class" designation, show in a table the depreciation and book value over the asset's l0-year life of use. The cost basis of...

-

What type of depreciation expense pattern is used under each of the following methods and when is its use appropriate? a. The straight-line method. b. The units-of-production method. c. The...

-

What are the institutional features that appear to have delayed the implementation of IFRS in India?

-

Calculate the availability of the water at the initial and final states of Problem 8.70, and the irreversibility of the process.

-

Starlight, Inc. must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis For each project, compute the expected rate...

-

What does this story illustrate about how creative ideas surface? LO.1

-

The absolute pressure within a 35.0-liter gas cylinder should not exceed 51.0 atm. Suppose the cylinder contains 50.0 mol of a gas. Use the SRK equation of state to calculate the maximum permissible...

-

\ table [ [ \ table [ [ Direct materials used in ] , [ production ] ] , 1 8 7 , 2 0 0 ] , [ \ table [ [ Total manufacturing ] , [ costs during the period ] ] , 3 4 1 , 0 0 0 ] , [ \ table [ [ Ending...

-

Tom filed his federal income tax return for 20x4 on November 29, 20x5. He had not applied for an extension of time to file. He was married but filed separately from his spouse. The return showed...

-

Below is information regarding the capital structure of Micro Advantage Inc. On the basis of this information you are asked to respond to the following three questions: Required 1. Micro Advantage...

-

Calculate the net after-tax cash flow effect of the following information: sales, $260; expenses other than depreciation, $140; depreciation expense, $50; marginal income tax rate, 35%.

-

Penguins are flightless birds. Emus are flightless birds. Ostriches are flightless birds. What conclusion can you draw from these premises? Draw a logical conclusion from the premises that includes...

-

Given the following differential equation, dydx = sin ( x + y ) Find the following: ( a ) The substitution u = ( b ) The transformed differential equation dudx = ( c ) The implicit solution, given...

-

Consider the following type declarations TYPE Alinteger; A2 pointer to float; A3 pointer to integer; T1 structure (x: integer; } T2 structure (x: A1; next pointer to integer; } b float; } a :...

-

https://www.viddler.com/embed/82b62f65 Questions: How do companies decide where to locate their facilities? Why has just-in-time inventory control become a dominant production process used in the...

-

Adjusting Entries for Interest At December 31 of Year 1, Portland Corporation had two notes payable outstanding (notes 1 and 2). At December 31 of Year 2, Portland also had two notes payable...

-

We want to get an idea of the actual mass of 235U involved in powering a nuclear power plant. Assume that a single fission event releases 200 MeV of thermal energy. A 1,000 MWe electric power plant...

-

Which of the following would preclude a taxpayer from deducting student loan interest expense? a . The total amount paid is $1,000 b. The taxpayer is single with AGI of $55,000. c. The taxpayer is...

-

4. Jobe dy -Y 2 et by

-

Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being organized are listed...

-

Glenn Grimes is the founder and president of Heartland Construction, a real estate development venture. The business transactions during February while the company was being organized are listed...

-

Environmental Services, Inc. performs various tests on wells and septic systems. A few of the companys business transactions occurring during August are described below: On August 1, the company...

-

XF Ltd. Is an expanding private company in the electric trade. Accounts preparing in January 2019 included the following information: Profit Statement for the year ended 31 st December 2018 Kshs.000...

-

Check On June 15, 2021, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington D.C., for $340 million. The expected completion date is April...

-

Q.1 Bassem Company purchased OMR420,000 in merchandise on account during the month of April, and merchandise costing OMR $350,000 was sold on account for OMR 425,000. Required: 1. Prepare journal...

Study smarter with the SolutionInn App