Rice is one of the staple foods in IVIali, West Africa, and, happily for this country, most

Question:

Rice is one of the staple foods in IVIali, West Africa, and, happily for this country, most of what is consumed annually (between 72% and 85%) is grown on the rice paddies along the Niger River. However, a certain amount must be imported every year to make up for the deficit. About 90% of this importation is done legally by two or three major importers, one of whose operations is described in the following case.

Mali's role in the world rice market is small. The country imports only 4% of the total rice traded in the world; the average amount over the past five years has been about 60,000 tons. Still, for rice traders in Mali, an extra thousand or two tons in inventory can mean disaster for the trader's bottom line, and too little will mean lost revenues and serious shortages for the population. So making final decisions regarding the future marketability of rice is a difficult business, and Amadou Takoure, Chief Financial Officer at one of the largest rice trading companies in Mali, was currently facing this process.

It was 10am on June 15, 1993, when Takoure was already feeling that the day had stretched too long in this hottest season of the year. He needed to budget rice imports for the year. Currently prices stood at $610, about $30 above the variable costs of importing rice (half of these variable costs are transportation and customs charges). Prices usually rise and fall, but by how much depends on the rains and whether demand is rising.

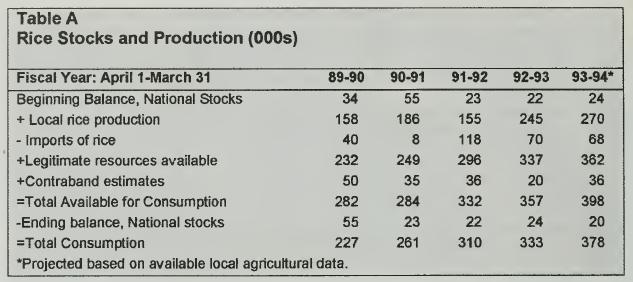

Making the final decision about how much rice to import for arrival on August 15 in time for the fall mari Takoure was also concerned about overhead costs and the overall profitability of the business, and he was wondering about the profitability of the different product lines. He knew that the accurate prediction of rice demand would play a role in these issues. He called over his trusted assistant Dramane Couilbaly, to talk through the company's cost constraints and get some fresh ideas. Takoure: Dramane, I need to get the right mariceting mix among our main products — rice, refrigerators, air conditioners, and tiles—^to cover our overtiead and realize a profit. I have to say that I am thoroughly frustrated with our inability to bring down overtiead costs, which continue to average $100,000 per month. Coulibaly: Well, you know we have the electric company, which seems to enjoy it enonnously when we tum on a bit of air conditioning. And at $10 per minute for the boss's overseas calls, no wonder our phone bill is so huge. Plus we have those huge interest payments on the financing of our imports. It won't help to complain—we just need to get the right product mix to cover it. And, as you know, part of covering the overhead is deciding on a reasonable allocation system. You know that we have been using your system for a few quarters, where we allocate based on relative sales dollars, but we never predict accurately what sales will be. We really need to be sure that we are at least trying to get prices adequate to cover all the costs. Takoure: You're right. We need to determine an allocation base that reflects our biggest headache, which is getting our merchandise sold as quickly as possible. Our tiles languish in the warehouse for an average of six months, our air conditioners for as long as four months, and our refrigerators as much as three months. Cun-ently our variable costs on tiles per ton are about $12,016; on air conditioners, per unit about $418; and on refrigerators per unit about $582. Coulibaly: Did I tell you that interest rates have just gone up 50 basis points to 18%? You l^now this means that the longer our goods stay in those warehouses, the more we pay in interest, which is part of our overhead. We have very favorable arrangements at the bank, where principal is due 120 days after the merchandise lands. Still, since we are borrowing 100 percent of our variable costs, the faster we can sell, the faster we can pay the principal. Takoure: By the way, what are we paying for our new warehouse? Coulibaly: The warehouse for the durable goods costs $1 ,500 per month and can hold 30 000 cubic feet of merchandise. I asked our warehouse supervisor to tell me how much oir each item we can fit into the place. He told me that the refrigerators take up about thirty cubic feet, the air condifioners require five, and each ton of tiles requires about fifty. Oh, and each ton of rice takes up one hundred cubic feet in a grain warehouse. And you may want to know the price of each of those 560,000 cubic foot grain warehouses, available as we need them, just doubled to one cent per cubic foot. Takoure: OK. According to my market calculafions, during this season we can import, store and eventually sell 600 refrigerators, 1,000 air condifioners, and 15 tons of files. I estimate prices on these will be about $720, $600, and $18,000. Before I can make a decision on rice imports, I am going to have to do a little inventory study on current rice stocks in the country, and call around to the rice associations. Rains have begun to fall and though it is probably too eariy to tell, some of these famiers are pretty good at predicting the harvest for December anyway. We need to make a decision by this afternoon on the total we will import. After calling the rice associafions, Takoure detennined that the harvest would probably increase from last year (rains have been good so far), and there would be at least 270,000 tons harvested in the 1993-4 season. (See T-A) If total consumption continued to rise, as it had over the past four years, to an average of 13.7% annually, then the consumption for 1994 would be 378,000 tons. If contraband imports retumed to the 36,000 ton level (a conservative estimate), then the total deficit would be 68,000 tons. His company tradifionally had a large share of the rice import martlet, about 40%, so Takoure figured he could import at least 27,000 tons. Right now he could buy rice at $580 per ton, including the cost of transportation and customs duty, and it would arrive on August 15. He expected that prices would rise, even with a good harvest, because of rising demand. He wanted to sell the first sacks of rice by mid-September for about $635 per ton, and he hoped to raise prices by 1% for each of the months of October and November Takoure expected that he would have to reduce prices to $630 in December during the harvest, and he hoped to have sold at least 26,000 tons by the New Year. He wondered whether fully absortied costs would be covered by these prices. REQUIRED: 1 What are the critical success factors for Takoure's business? What part does international trade play in these CSFs? 2. What are some possible allocation bases for the $1 ,200,000 overtiead that Takoure might want to consider, given the information available? Choose the allocation method you prefer, explain why, and calculate the overtiead allocation using this method.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin