The challenge of operating efficiently is spelled out in the rate agreement. Our interim goal is to

Question:

The challenge of operating efficiently is spelled out in the rate agreement. Our interim goal is to reduce annual operation and maintenance expense (other than fuel and purchased power) by $40 million to $100 million by 1991 . No Company activity is off limits where cost cutting is concerned, except where cost-cutting would reduce the quality of our service to customers or endanger our employees or the public.

(From Centerior Energy Corporation 1988 Annual report)

BACKGROUND Centerior Energy Corporation was created in 19X5 as a holding company for the Cleveland Electric Illumination Company (CEI) and Toledo Edison (TEd). CEI and TEd are electric utilities serving market areas in northeastern and northwestern Ohio, respectively. As a result of the formation of Centerior Energy, Centerior Service Company was formed to provide administrative and engineering services to CEI and TEd. Centerior Energy Corporation and Centerior Service Company operate under the rules and regulations of the SEC for public utility holding companies; Centerior Service Company, CEI, and TEd are regulated by the Federal Energy Regulatory Commission (FERC) and the Public Utilities Commission of the State of Ohio (PUCO).

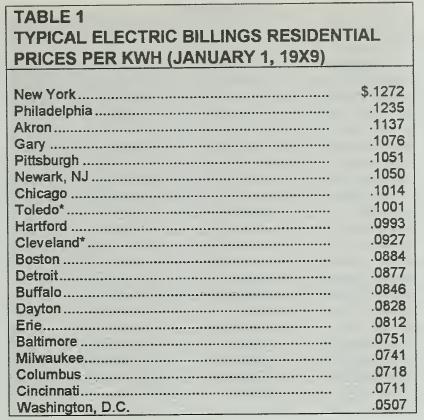

The rate agreement referred to in the above excerpt became effective on February 1, 19X9. Additional rate increases were to follow in 19Y0 and 19Y1 . The PUCO attached to this rate agreement a requirement that Centerior Energy not only establish fair and reasonable productivity standards for generating units but also reduce the costs of operating and maintaining the units' generating capacity. After the February 1, 19X9 rate increase, CEI's and TEd's prices to residential customers for 500 kilowatt-hours of service were

$10.10 and $11.30 per kilowatt-hour, respectively. (See T-1 for a chart of typical electric billings as of January 1 , 19X9 in selected northern cities.)

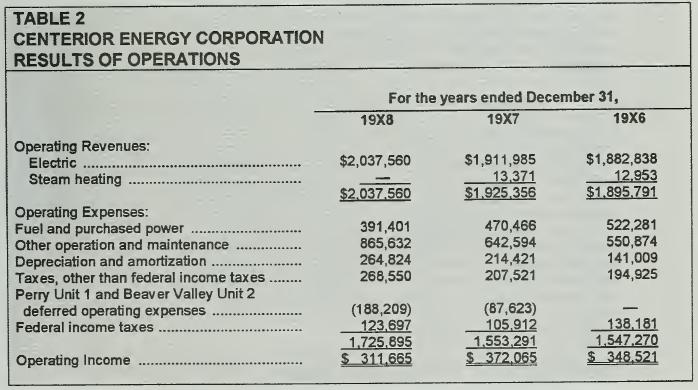

Although revenues had increased since 19X6, operating income at Centerior had decreased, due principally to growth in operation and maintenance expense as well as in depreciation and amortization. Centerior was especially concerned about managing the operation and maintenance expense because of its dramatic recent growth and its immediate demands for cash for current operating purposes. (See T-2 for three years'

comparative results of operations for Centerior Energy.)

ACCOUNTING SYSTEMS In the early 19X0s, TEd had developed concepts for activity accounting that accumulated costs at a relatively low level of aggregation to activities such as maintaining poles, operating boilers, and replacing transformers. In addition, TEd had developed allocation systems that assigned indirect costs on the basis of standards which reflected flexible activity levels. TEd's accounting system had been in place for about 35 years without major changes. Upper, middle, and lower management had become accustomed to managing their activities using reports that captured costs at the activity level.

CEI's accounting system, on the other hand, captured costs at a much higher level of aggregation. It was used to control labor and material costs at the operating department level on a monthly basis. These costs were assigned directly to departments rather than to activities. Indirect costs were accumulated at headquarters and allocated monthly to the operating departments. First-line managers were unaccustomed to receiving cost reports from the accounting system. For the most part, the accounting and work management systems were not compatible with each other. Accounting cost information was provided only to executive and middle management. The manner in which the two operating companies budgeted for costs differed dramatically, reflecting differences in the cost systems. TEd's budget was prepared by

|

estimating activity levels throughout the entire organization for the budget penod. Costs were subsequently traced to activities across departmental lines. CEI budgeted at the department level, without the same emphasis on tracing the impact of one department's operating decisions on other units of the company.

MANAGEMENT ACCOUNTING RESPONSE

"There were really two parts of our charge to create a new accounting system for Centerior Energy," explained Jack Flick, the corporation's Manager of Accounting Systems. "First, as our part of the company-wide commitment to reduce operating costs, we were expected to implement a system or systems that would streamline the accounting functions within Centerior. Prior to the rate agreement there were 45 accountants at Centerior Sen/ice, 180 at CEI, and 65 at TEd, for a total of 290. Top management challenged us to create and implerrient a corporation-wide accounting system that would reduce that number.

"Second, the PUCO placed a challenge before us to manage our costs more effectively.

To do that we had to think in terms of an overall cost management system that would satisfy the regulatory requirements. Our biggest hurdle was the immense difference in cost management traditions in the two operating companies, CEI and Toledo Edison. Even though Toledo Edison's system was based on concepts which we believed to be sound, its age—about 35 years—and its dedicated computer system—which was pretty inflexiblepresented very real problems. It was not possible to make adjustments to the old system in order to fix it adequately for the 19Y0s.

"CEI was entirely different. Its accounting system was even older and conceptually never had reached the level of costing activities. Especially difficult for us were the problems created by the system of cost allocafion. For example, repair departments were allocated actual costs of the warehouse on a monthly basis according to the number of

^

actual requisitions. That meant that everybody tried to requisition warehouse items in the \

busy summer months and avoid requisitions in the winter when little work was done. Repair units would inflate their requisitions in the summer and stockpile parts. This is only one of a multitude of ways in which the costing system created management problems."

REQUIRED:

1

.

Based on the brief description of CEI's and TEd's accounting systems, identify their cost objects. How does any difference in cost objects relate to management control and cost management problems that may arise from the affiliation of the two companies?

2. Should accounting systems remain decentralized to the operating companies or be centralized at Centerior Service Company?

3. What are the benefits and costs of an activity-based approach to cost attribution, budgeting, and management performance evaluation throughout Centerior Energy?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin