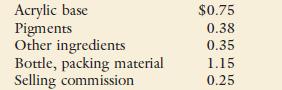

Chromatics, Inc., produces novelty nail polishes. Each bottle sells for ($3.60). Variable unit costs are as follows:

Question:

Chromatics, Inc., produces novelty nail polishes. Each bottle sells for \($3.60\). Variable unit costs are as follows:

Fixed overhead costs are \($12,000\) per year. Fixed selling and administrative costs are \($6,720\) per year. Chromatics sold 35,000 bottles last year.

Required:

1. What is the contribution margin per unit for a bottle of nail polish? What is the contribution margin ratio?

2. How many bottles must be sold to break even? What is the break-even sales revenue?

3. What was Chromatics’s operating income last year?

4. What was the margin of safety?

5. Suppose that Chromatics, Inc., raises the price to \($4.00\) per bottle, but anticipated sales will drop to 30,400 bottles. What will the new break-even point in units be? Should Chromatics raise the price? Explain.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen