Karmee Company has been accumulating operating data in order to prepare an annual profit plan. Details regarding

Question:

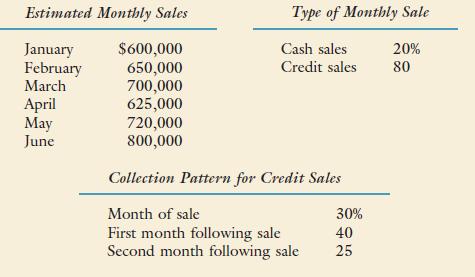

Karmee Company has been accumulating operating data in order to prepare an annual profit plan. Details regarding Karmee’s sales for the first six months of the coming year are as follows:

Karmee’s cost of goods sold averages 40 percent of the sales value. Karmee’s objective is to maintain a target inventory equal to 30 percent of the next month’s sales. Purchases of merchandise for resale are paid for in the month following the sale.

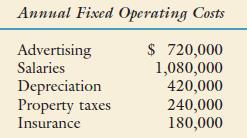

The variable operating expenses (other than cost of goods sold) for Karmee are 10 percent of sales and are paid for in the month following the sale. The annual fixed operating expenses follow. All of these are incurred uniformly throughout the year and paid monthly except for insurance and property taxes. Insurance is paid quarterly in January, April, July, and October. Property taxes are paid twice a year in April and October.

Required:

Form groups of two or three. Within each group, calculate the following:

1. The amount of cash collected in March for Karmee Company from the sales made during March.

2. Karmee Company’s total cash receipts for the month of April.

3. The purchases of merchandise that Karmee Company will need to make during February.

4. The amount of cost of goods sold that will appear on Karmee Company’s pro forma income statement for the month of February.

5. The total cash disbursements that Karmee Company will make for the operating expenses (expenses other than the cost of goods sold) during the month of April.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen