Paula Barneck, the newly appointed director of the Lambert Medical Center (LMC), a large metropolitan hospital, was

Question:

Paula Barneck, the newly appointed director of the Lambert Medical Center (LMC), a large metropolitan hospital, was reviewing the financial report for the most recent quarter.

The hospital had again shown a loss. For the past several years, it had been struggling financially. The financial problems had begun with the introduction of the federal government’s new diagnostic-related group (DRG) reimbursement system. Under this system, the government mandated fixed fees for specific treatments or illnesses. The fixed fees were supposed to represent what the procedures should cost and differed from the traditional cost objective of the patient day of prior years. Although no formal assessment had been made, the general feeling of hospital management was that the DRG reimbursement was hurting LMC’s financial state.

The increasing popularity of health maintenance organizations (HMOs) and physician provider organizations (PPOs) was also harming the hospital’s financial well-being.

In HMOs, physicians, who are employed full time, are usually located in a clinic owned by the HMO, and subscribers must use these physicians. In PPOs, hospitals provide contracts with a group of physicians in private practice. These physicians usually serve non-PPO patients as well as PPO patients. The PPO patient can select any physician from the list of physicians under contract with the particular PPO. The PPO approach usually offers a greater selection of physicians and tends to preserve the patient’s traditional freedom of choice. More and more of the hospital’s potential patients were joining HMOs and PPOs, and, unfortunately, LMC was not capturing its fair share of the HMO and PPO business. HMOs and PPOs routinely asked for bids on hospital services and provided their business to the lowest bidder. In too many cases, LMC had not won that work.

Paula had accepted the position of hospital administrator knowing that she was expected to produce dramatic improvements in LMC’s financial state. She was convinced that she needed more information about the hospital’s product costing methods.

Only by having accurate cost information for the various procedures offered by the hospital could she evaluate the effects of DRG reimbursement and the hospital’s bidding strategy.

Paula requested a meeting with Eric Rose, the hospital’s controller. Their conversation follows:

PAULA: Eric, as you know, we recently lost a bid on some laboratory tests that would be performed on a regular basis for a local HMO. In fact, I was told by the director of the HMO that we had the highest bid of the three submitted. I know the identity of the other two hospitals that submitted bids, and I have a hard time believing that their costs for these tests are any lower than ours. Describe exactly how we determine the cost of these lab procedures.

ERIC: First, we classify all departments as either revenue-producing centers or service centers. Next, the costs of the service centers are allocated to the revenueproducing centers. The costs directly traceable to the revenue-producing centers are then added to the allocated costs to obtain the total cost of operating the revenueproducing center. This total cost is divided by the total revenues of the revenueproducing center to obtain a cost-to-charges ratio. Finally, the cost of a particular procedure is computed by multiplying the charge for that procedure by the cost-tocharges ratio.

PAULA: Let me see if I understand. The costs of laundry, housekeeping, maintenance, and other service departments are allocated to all of the revenue-producing departments. Let’s assume that the lab receives $100,000 as its share of these allocated costs. The $100,000 is then added to the direct costs—let’s assume these are also $100,000—to obtain total operating costs of $200,000. If the laboratory earns revenues of $250,000, the cost-to-charges ratio is 0.80 ($200,000/$250,000). Finally, if I want to know the cost of a particular lab procedure, say a blood test for which we normally charge $20, then all I do is multiply the cost-to-charges ratio of 0.8 by $20 to obtain the cost of $16. Am I right?

ERIC: Absolutely. In the laboratory testing bid that we just lost, our bid was at cost, as computed using our cost-to-charges formula. Perhaps the other hospitals are bidding below their cost to capture the business.

PAULA: Eric, I don’t agree. The cost-to-charges ratio is a traditional approach for costing hospital products, but I’m afraid that it is no longer useful. Given the new environment in which we’re operating, we need more accurate product costing information.

We need accuracy to improve our bidding, to help us assess and deal with the new DRG reimbursement system, and to evaluate the mix of services we offer. The cost-to-charges ratio approach backs into the product cost. It is indirect and inaccurate.

Some procedures require more labor, more materials, and more expensive equipment than others. The cost-to-charges approach doesn’t reflect these potential differences.

ERIC: Well, I’m willing to change the cost accounting system so that it meets our needs. Do you have any suggestions?

PAULA: Yes. I’m in favor of a more direct computation of product costs. Allocating support service costs to the revenue-producing departments is only the first stage in product costing. We do need to allocate these support service costs to the producing departments—but we need to be certain that we are allocating them in the right way.

We also need to go a step further and assign the costs accumulated in the revenueproducing departments to individual products. The costs directly traceable to each product should be identified and assigned directly to those products; indirect costs can be assigned through one or more overhead rates. The base for assigning the overhead costs should be associated with their incurrence. If at all possible, allocations should reflect the usage of support services by the revenue-producing departments;

moreover, the same criterion should govern the assignment of overhead costs to the products within the department.

ERIC: Sounds like an interesting challenge. With over 30,000 products, a job-order costing system would be too burdensome and costly. I think some system can be developed, however, that will do essentially what you want.

PAULA: Good. Listen, for our next meeting, come prepared to brief me on why and how you allocate these service department costs to the revenue-producing departments.

I think this is a critical step in accurate product costing. I also want to know how you propose to assign the costs accumulated in each revenue-producing department to that department’s products.

As Eric mentally reviewed his meeting with Paula, he realized that the failure of bids could be attributable to inaccurate cost assignments. Because of this possibility, Eric decided to do some additional investigation to see if the cost-to-charges ratio method of costing services was responsible.

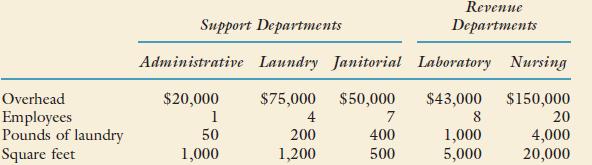

Eric pulled the current year’s budgeted data from his files. He found the following data. The number of departments and the budget have been reduced for purposes of simplification.

Support department costs are allocated using the direct method.

Eric decided to compute the costs of three different lab tests using the cost-to-charges ratio and then recompute them using a more direct method, as suggested by Paula. By comparing the unit costs under each approach, he could evaluate the cost-estimating ability of the cost-to-charges ratio. The three tests selected for study were the blood count test (Test B), cholesterol test (Test C), and a chemical blood analysis (Test CB).

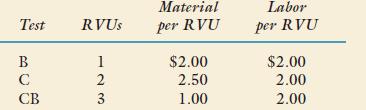

After careful observation of the three tests, Eric concluded that the consumption of the resources of the laboratory could be associated with the relative amount of time taken by each test. Based on the amount of time needed to perform each test, Eric developed relative value units (RVUs) and associated the consumption of materials and labor with these units. The RVUs for each test and the cost per RVU for materials and labor are as follows:

Eric also concluded that the pool of overhead costs collected within the laboratory should be applied using RVUs. (He was convinced that RVU was a good activity driver for overhead.) The laboratory’s expected RVUs for the year were 22,500. The laboratory usually performs an equal number of the three tests over a year. This year was no exception.

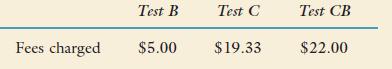

Eric also noted that the hospital usually priced its services so that revenues exceeded costs by a specified percentage. Based on the past total costs of the laboratory, this pricing strategy had led to the following fees for the three blood tests:

Required:

1. Allocate the costs of the support departments to the two revenue-producing departments using the direct method.

2. Assuming that the three blood tests are the only tests performed in the laboratory, compute the cost-to-charges ratio (total costs of the laboratory divided by the laboratory’s total revenues).

3. Using the cost-to-charges ratio computed in Requirement 2, estimate the cost per test for each blood test.

4. Compute the cost per test for each test using RVUs.

5. Which unit cost—the one using the cost-to-charges ratio or the one using RVUs—do you think is the most accurate? Explain.

6. Assume that Lambert Medical Center has been requested by an HMO to bid on Test CB. Using a 5 percent markup, prepare the bid using the cost computed in Requirement 3. Repeat, using the cost prepared in Requirement 4. Suppose that anyone who bids $20 or less will win the bid. Discuss the implications of costing accuracy on the hospital’s problems with its bidding practices.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen