Portland Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As

Question:

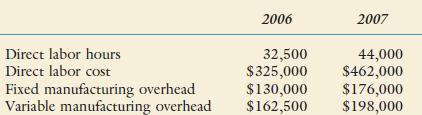

Portland Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. Portland’s predetermined overhead rates for 2006 and 2007 were based on the following estimates:

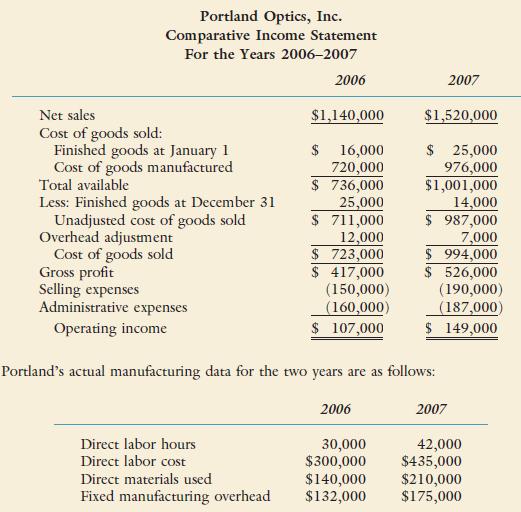

Jim Bradford, Portland’s controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of Portland’s management team, Jim plans to convert the company’s income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of Portland’s 2006–2007 comparative income statement.

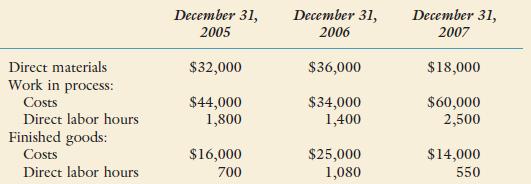

The company’s actual inventory balances were as follows:

For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. Portland reports any over- or underapplied overhead as an adjustment to the cost of goods sold.

Required:

1. For the year ended December 31, 2007, prepare the revised income statement for Portland Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement.

2. Describe two advantages of using variable costing rather than absorption costing.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen