Roberts Company is considering an investment in equipment that is capable of producing electronic parts twice as

Question:

Roberts Company is considering an investment in equipment that is capable of producing electronic parts twice as fast as existing technology. The outlay required is

\($2,340,000\). The equipment is expected to last five years and will have no salvage value.

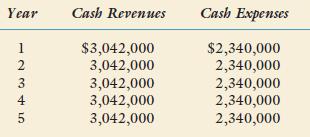

The expected cash flows associated with the project are as follows:

Required:

1. Compute the project’s payback period.

2. Compute the project’s accounting rate of return on:

a. Initial investment

b. Average investment 3. Compute the project’s net present value, assuming a required rate of return of 10 percent.

4. Compute the project’s internal rate of return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen

Question Posted: