Tasty Apple, an apple chip manufacturer, was established in 1972 by Katherine English. In 2002, Katherine English

Question:

Tasty Apple, an apple chip manufacturer, was established in 1972 by Katherine English. In 2002, Katherine English died, and her son, Mark, took control of the business. By 2007, the company was facing stiff competition from national snack-food companies. Mark was advised that the company’s plants needed to gain better control over production costs. To achieve this objective, he hired a consultant to install a standard costing system. To help the consultant in establishing the necessary standards, Mark sent her the following memo:

The manufacturing process for our chips begins when the apples are placed into a large vat in which they are automatically washed. After washing, the apples flow directly to equipment that automatically peels and removes the apple’s core. The peeled and decored apples then pass by inspectors who manually cut out deep bruises or other blemishes. After inspection, the apples are automatically sliced and dropped into the cooking oil. The frying process is closely monitored by an employee. After they are cooked, the chips pass by more inspectors, who sort out the unacceptable finished chips (those that are discolored or too small). The chips then continue on the conveyor belt to a bagging machine that bags them in 1-pound bags. The bags are then placed in a box and shipped. Each box holds 16 bags.

The raw apple pieces (bruised and blemished), peelings, and rejected finished chips are sold to animal feed producers for \($0.08\) per pound. The cores are sold to a juice producer for \($0.16\) per pound. The company uses this revenue to reduce the cost of apples; we would like this fact reflected in the price standard relating to apples.

Tasty Apple purchases high-quality apples at a cost of \($0.256\) per pound. Each apple averages 4.25 ounces. Under efficient operating conditions, it takes four apples to produce one 16-ounce bag of chips. Although we label bags as containing 16 ounces, we actually place 16.2 ounces in each bag. We plan to continue this policy to ensure customer satisfaction. In addition to apples, other raw materials are the cooking oil, cinnamon, bags, and boxes. Cooking oil costs \($0.04\) per ounce, and we use 3.3 ounces of oil per bag of chips. The cost of cinnamon is so small that we add it to overhead.

Bags cost \($0.12\) each and boxes $0.62.

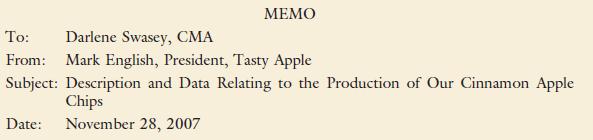

Our plant produces 9.2 million bags of chips per year. A recent engineering study revealed that we would need the following direct labor hours to produce this quantity if our plant operates at peak efficiency:

I’m not sure that we can achieve the level of efficiency advocated by the study. In my opinion, the plant is operating efficiently for the level of output indicated if the hours allowed are about 10 percent higher.

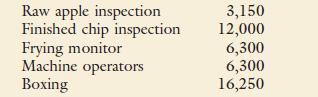

The hourly labor rates agreed upon with the union are as follows:

Overhead is applied on the basis of direct labor dollars. We have found that variable overhead averages about 112 percent of our direct labor cost. Our fixed overhead is budgeted at \($2,419,026\) for the coming year.

Required:

Form groups of three or four students. Each group should complete the following requirements.

One member from each group will rotate to another group. The rotating member has the responsibility of comparing and contrasting the solution of his or her group with that of the group being visited.

1. Discuss the benefits of a standard costing system for Tasty Apple.

2. Discuss the president’s concern about using the result of the engineering study to set the labor standards. What standard would you recommend?

3. Develop a standard cost sheet for Tasty Apple’s cinnamon apple chips.

4. Suppose that the level of production was 9.2 million bags of apple chips for the year as planned. Assuming that 9.8 million pounds of apples were used, compute the direct materials usage variance for apples.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen