Welcome Inns is a chain of motels serving business travelers in Arizona and southern Nevada. The chain

Question:

Welcome Inns is a chain of motels serving business travelers in Arizona and southern Nevada. The chain has grown from one motel in 2004 to five motels. In 2007, the owner of the company decided to set up an internal accounting department to centralize control of financial information. (Previously, local CPAs handled each motel’s bookkeeping and financial reporting.) The accounting office was opened in January 2007 by renting space adjacent to corporate headquarters in Glendale, Arizona. All motels have been supplied with personal computers and modems by which to transfer information to central accounting on a weekly basis.

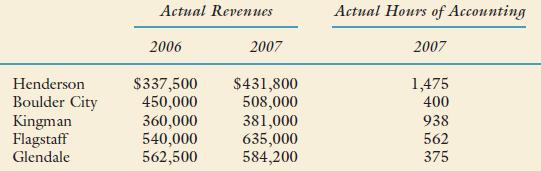

The accounting department has budgeted fixed costs of $85,000 per year. Variable costs are budgeted at $26 per hour. In 2007, actual cost for the accounting department was $182,500. Further information is as follows:

Required:

1. Suppose the total costs of the accounting department are allocated on the basis of 2007 sales revenue. How much will be allocated to each motel?

2. Suppose that Welcome Inns views 2006 sales figures as a proxy for budgeted capacity of the motels. Thus, fixed accounting department costs are allocated on the basis of 2006 sales, and variable costs are allocated according to 2007 usage multiplied by the variable rate. How much accounting department cost will be allocated to each motel?

3. Comment on the two allocation schemes. Which motels would prefer the method in Requirement 1? The method in Requirement 2? Explain.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen