Jennifer has just been promoted to manager of the piston division of Auto Parts Co. The division,

Question:

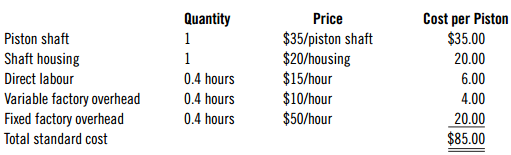

The fixed overhead rate is based on an estimated 1,000 units per month. Direct labour is nearly a fixed cost in this division. Selling and administrative costs are $50,000 per month plus $10 per piston sold.

The following information is for production during April:

Number of pistons manufactured.....................950

Purchase of 1,000 piston shafts................$34,950

Piston shafts used............................................954

Purchase of 1,000 shaft housings.............$20,000

Shaft housings used.........................................950

Direct labour costs (397 hours)..................$ 6,120

Variable factory overhead costs.................$ 3,677

Fixed factory overhead costs....................$18,325

Selling and administrative costs................$59,101

The company€™s policy is to record materials price variances at the time materials are purchased. You may want to use a spreadsheet to perform calculations.

Required:

A. Prepare a flexible cost budget for the month of April.

B. Calculate all the common direct cost variances. (Note: There are no variances for shaft housings.)

C. Calculate all common factory overhead variances.

D. Calculate a total variance for the selling and administrative costs.

E. Prepare a complete, yet concise, report that would be useful in evaluating control of production costs for April.

F. Prepare a report that sums all the variances necessary to prepare the reconciling journal entry at the end of the period. Explain how you would close the total variance; that is, identify the account or accounts that would be affected and whether expenses in the accounts will be increased or decreased to adjust the records for the total variance.

G. Suppose you are manager of the piston division, and you are reviewing the report prepared in Part E. Use information in the report to identify questions you might have about April€™s production costs.

Step by Step Answer:

Cost Management Measuring, Monitoring And Motivating Performance

ISBN: 1601

3rd Canadian Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook