Amazon, in the authors opinion, has cared less about profitability in the short run but has cared

Question:

Amazon, in the author’s opinion, has cared less about profitability in the short run but has cared about gaining market share. Arguably Amazon gains market share by taking care of the customer. Given the “Suggested 75 KPIs That Every Manager Needs to Know” from Exhibit 7-5, what would be a natural KPI for the customer aspect for Amazon? How do digital dashboards make KPIs easier to track?

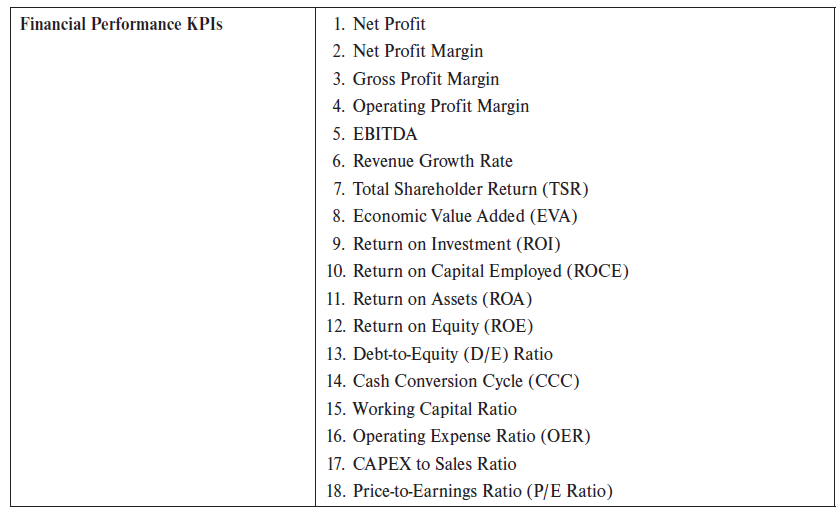

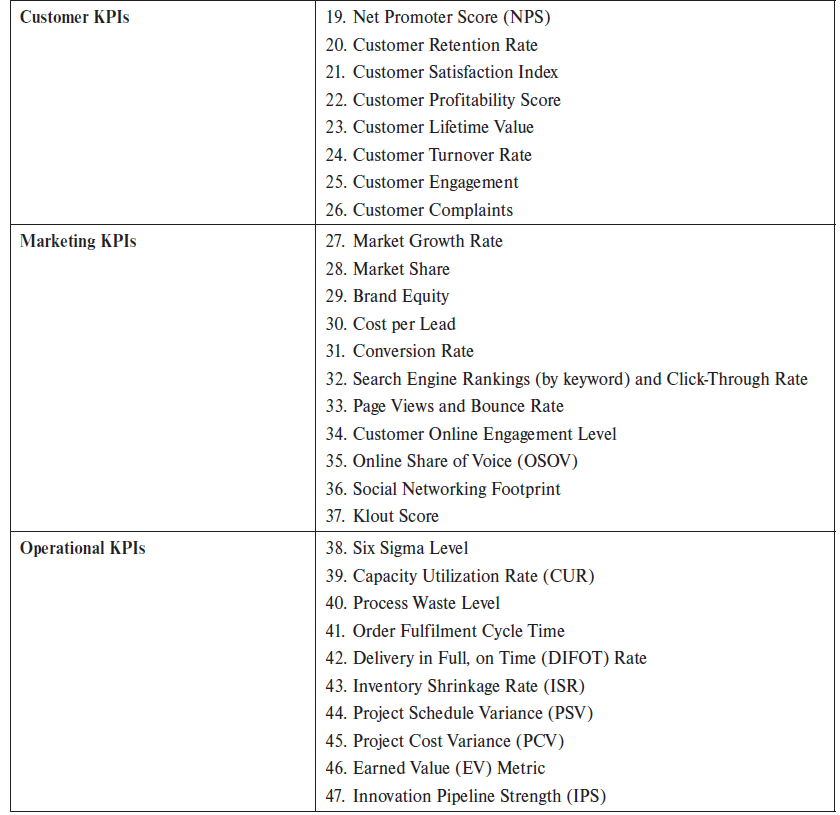

Exhibit 7-5

1. Net Profit Financial Performance KPIS 2. Net Profit Margin 3. Gross Profit Margin 4. Operating Profit Margin 5. EBITDA 6. Revenue Growth Rate 7. Total Shareholder Return (TSR) 8. Economic Value Added (EVA) 9. Return on Investment (ROI) 10. Return on Capital Employed (ROCE) 11. Return on Assets (ROA) 12. Return on Equity (ROE) 13. Debt-to-Equity (D/E) Ratio 14. Cash Conversion Cycle (CCC) 15. Working Capital Ratio 16. Operating Expense Ratio (OER) 17. CAPEX to Sales Ratio 18. Price-to-Earnings Ratio (P/E Ratio) Customer KPIS 19. Net Promoter Score (NPS) 20. Customer Retention Rate 21. Customer Satisfaction Index 22. Customer Profitability Score 23. Customer Lifetime Value 24. Customer Turnover Rate 25. Customer Engagement 26. Customer Complaints Marketing KPIS 27. Market Growth Rate 28. Market Share 29. Brand Equity 30. Cost per Lead 31. Conversion Rate 32. Search Engine Rankings (by keyword) and Click-Through Rate 33. Page Views and Bounce Rate 34. Customer Online Engagement Level 35. Online Share of Voice (OSOV) 36. Social Networking Footprint 37. Klout Score Operational KPIS 38. Six Sigma Level 39. Capacity Utilization Rate (CUR) 40. Process Waste Level 41. Order Fulfilment Cycle Time 42. Delivery in Full, on Time (DIFOT) Rate 43. Inventory Shrinkage Rate (ISR) 44. Project Schedule Variance (PSV) 45. Project Cost Variance (PCV) 46. Earned Value (EV) Metric 47. Innovation Pipeline Strength (IPS)

Step by Step Answer:

Customer retention rate customer satisfac...View the full answer

Related Video

Return on capital employed or ROCE is a profitability ratio that measures how efficiently a company can generate profits from its capital employed by comparing net operating profit to capital employed. In other words, the return on capital employed shows investors how many dollars in profits each dollar of capital employed generates. ROCE is a long-term profitability ratio because it shows how effectively assets are performing while taking into consideration long-term financing

Students also viewed these Business questions

-

The airline industry is one of the more volatile industries. During lean years in the early 1990s, the industry wiped out the earnings it had reported during its entire history. Pan American Airlines...

-

Founded in 1908, General Motors Corp. (GM) is truly an iconic American corporation. From 1931 through 2008, GM was the world's largest automobile manufacturer, and in 1955, it became the first...

-

The following is a description of various factors that affected the operations of Lincoln Federal Savings and Loan, a California savings and loan (S&L). It was a subsidiary of American Continental...

-

What minimum force f , applied horizontally to the wheel axis, is needed to bring the wheel up to the height step h ? Tomer as the wheel radius and w as its weight. Tip: apply the equilibrium...

-

Evaluate

-

Prove that the continuoustime LTI system (15.20) is asymptotically stable (or stable, for short) if and only if all the eigenvalues of the A matrix, /(A), i = 1, . . . , n, have (strictly) negative...

-

Explain the accounting for long-term notes payable.

-

Analyzing and Interpreting Return on Assets Tiffany & Co. is one of the worlds premier jewelers and a designer of other fine gifts and housewares. Presented here are selected income statement and...

-

A borrower is purchasing a property for $725,000 and can choose between two possible loan alternatives. The first is 85% LTV loan for 30 years at 3.5% interest and 1 point and the second is at 70%...

-

The Shannon Corporation has credit sales of $750,000. Given the following ratios, fill in the balance sheet at the bottom. Total assets turnover .................................... 2.5 times Cash to...

-

We know that a Balanced Scorecard is comprised of four components: financial (or stewardship), customer (or stakeholder), internal process, and organizational capacity (or learning and growth). What...

-

For an accounting firm like PwC, how would the Balanced Scorecard help balance the desire to be profitable for its partners with keeping the focus on its customers?

-

What is an estimated liability? AppendixLO1

-

What is the formula for Bouley's coefficient of skewness?

-

What is the relation between orthocentre,circumcentre and centroid of a triangle?

-

When do we use Fourier transforms and Laplace transforms in RC/RL/RLC circuit analysis?

-

What are the protocols used in a drone?

-

How do we design a drone?

-

For the following exercises, use a graphing calculator to evaluate. sin I) cos(= -91 4 6

-

Determine which of the following limits exist. Compute the limits that exist. lim x-0 1- + 3x X

-

What kinds of businesses collect cash before recording the corresponding sales? How would that different sequence affect internal control requirements?

-

The sales and collection process generates revenue, accounts receivable, and cash flow information for a firms financial statements. What other information do you think managers would like to collect?

-

The sales and collection process generates revenue, accounts receivable, and cash flow information for a firms financial statements. What other information do you think managers would like to collect?

-

Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs associated with a ton of pulp follow: Selling...

-

The AICPA guidelines suggest that taxes should be transparent and visible. This means that: a. The taxes affect similarly situated taxpayers in a similar manner. b. Taxes should be due at the same...

-

What is Apple Companys strategy for success in the marketplace? Does the company rely primarily on customer intimacy, operational excellence, or product leadership? What evidence supports your...

Study smarter with the SolutionInn App