Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial liabilities.

Solvency Ratio

To assess that a business has the ability to meet its debt obligations, in the long run, there are three key ratios that come under solvency ratios.

Debt to Equity Ratio: This ratio tells the weight of debt as compared to equity in the capital structure. Higher the debt ratio, the lower is the solvency of the business. It is calculated as follows:

Debt to Total Assets Ratio: This ratio tells about the percentage of assets that are covered by liabilities. Higher the debt to total assets ratio, the higher is the financial risk for creditors. The formula for debt to asset ratio is:

Interest Coverage Ratio: This is a measure of interest burden that a business’s operating profits can lift. The higher the interest coverage ratio, the lesser is the risk of nonpayment of interest to creditors. It is calculated using the following formula:

Solvency Vs Liquidity

While solvency measures a company’s ability to settle non-current liabilities, liquidity measures a company's ability to pay its current liabilities. Assessment of liquidity is very important and to do that there are current ratio and acid test ratio that gives us a better picture of current assets and their convertibility into cash in a short span of time. Some organizations with low liquidity can be declared as bankrupt even if the solvency is high.

Solvency Ratio Formula

There are three ratios to measure a company’s solvency.

Solvency Ratio Examples

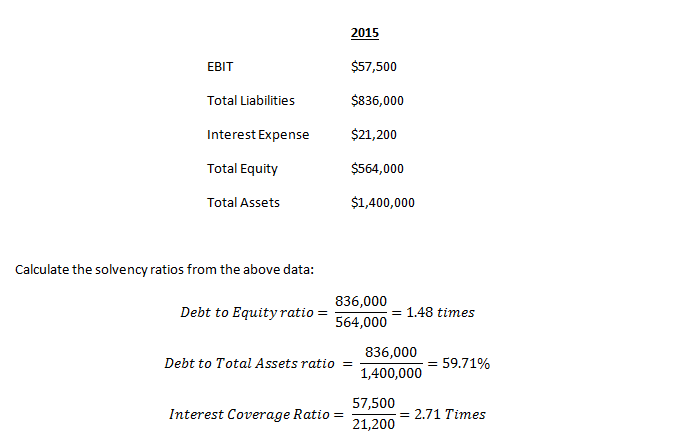

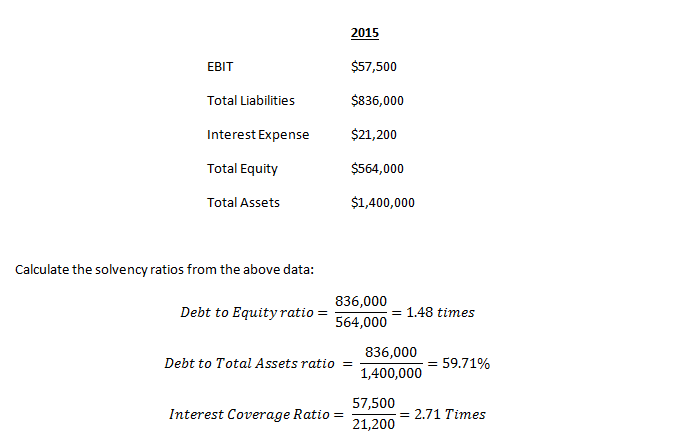

Consider a company has the following data: