A trader shorts one share of a stock index for 50 and buys a 60-strike European call

Question:

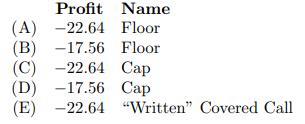

A trader shorts one share of a stock index for 50 and buys a 60-strike European call option on that stock that expires in 2 years for 10. Assume the annual effective risk-free interest rate is 3%. The stock index increases to 75 after 2 years. Calculate the profit on your combined position, and determine an alternative name for this combined position.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: