Assume the Black-Scholes framework. You are given the following information about two stocks: (i) (ii) The correlation

Question:

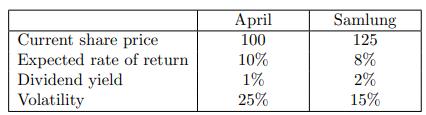

Assume the Black-Scholes framework. You are given the following information about two stocks:

(i)

(ii) The correlation between the continuously compounded returns on the two stocks is −0.3.

(iii) The continuously compounded risk-free interest rate is 6%.

Consider a 3-year European exchange option giving its holder the right to exchange one share of Samlung for one share of April after three years.

Calculate the probability that this exchange option will be exercised.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: