Prices for 6-month 60-strike European up-and-out call options on a stock S are available. Below is a

Question:

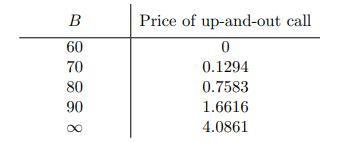

Prices for 6-month 60-strike European up-and-out call options on a stock S are available. Below is a table of option prices with respect to various B, the level of the barrier. Here, S(0) = 50.

Consider a special 6-month 60-strike European “knock-in, partial knock-out” call option that knocks in at B1 = 70, and “partially” knocks out at B2 = 80. The strike price of the option is 60. The following table summarizes the payoff at the exercise date:

![B Not Hit 0 B Hit B Not Hit 2 x max[S(0.5) - 60,0] B2 Hit max[S(0.5) - 60,0]](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/5/4/380655ded2c5c18e1700654379873.jpg)

Calculate the price of the option.

(A) 0.6289

(B) 1.3872

(C) 2.1455

(D) 4.5856

(E) It cannot be determined from the information given above.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: