The current price of a medical company's stock is 75. The expected value of the stock price

Question:

The current price of a medical company's stock is 75. The expected value of the stock price in three years is 90 per share. The stock pays no dividends.

You are also given:

(i) The risk-free interest rate is positive.

(ii) There are no transaction costs.

(iii) Investors require compensation for risk.

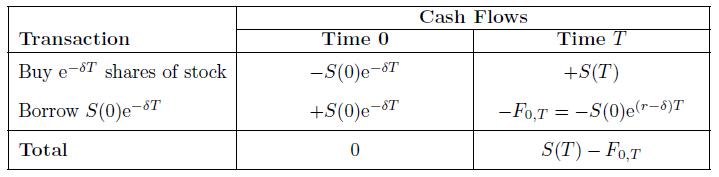

The price of a three-year forward on a share of this stock is X, and at this price an investor is willing to enter into the forward.

Determine what can be concluded about X.

(A) X

(B) X = 75

(C) 75

(D) X = 90

(E) 90

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: