The current price of a nondividend-paying stock is 100. The annual effective risk-free interest rate is 4%,

Question:

The current price of a nondividend-paying stock is 100. The annual effective risk-free interest rate is 4%, and there are no transaction costs.

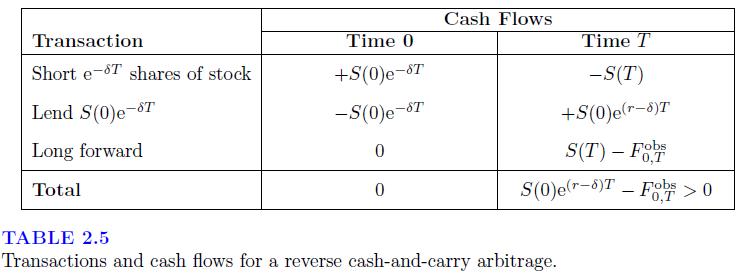

The stock's two-year forward price is mispriced at 108, so to exploit this mispricing, an investor can short a share of the stock for 100 and simultaneously take a long position in a two-year forward contract. The investor can then invest the 100 at the risk-free rate, and nally buy back the share of stock at the forward price after two years.

Determine which term best describes this strategy.

(A) Hedging

(B) Immunization

(C) Arbitrage

(D) Paylater

(E) Diversification

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: