The current price of stock XYZ is 1,000, and the continuously compounded risk-free interest rate is 8%.

Question:

The current price of stock XYZ is 1,000, and the continuously compounded risk-free interest rate is 8%. A dividend will be paid at the end of every 2 months over the next year, with the first dividend occurring 2 months from now. The amount of the first dividend is 12 = 1, that of the second dividend is 22 = 4. In general, the amount of the nth dividend is n2 , for n = 1, 2, . . . , 6.

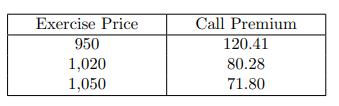

The following table shows the premiums of 1-year call options on stock XYZ of various exercise prices:

You create a one-year 950-1,020-1,050 long asymmetric butterfly spread with the following characteristics:

• The maximum payoff of 210 is attained when the stock price at expiration is 1,020.

• The payoff is strictly positive only when the stock price at expiration is strictly between 950 and 1,050.

• Only put options are used in the construction of the butterfly spread.

Calculate all possible 1-year stock price(s) that result(s) in a profit of 15.

Step by Step Answer: