The following table shows 1-year European call and put option premiums at two strike prices The continuously

Question:

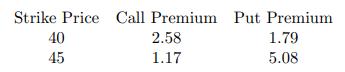

The following table shows 1-year European call and put option premiums at two strike prices

The continuously compounded risk-free interest rate is 6%.

The continuously compounded risk-free interest rate is 6%.

Describe actions you could take to construct an arbitrage strategy that results in profits at the end of one year using the above options and/or zero-coupon bonds only

Transcribed Image Text:

Strike Price Call Premium Put Premium 1.79 2.58 1.17 5.08 40 45

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (10 reviews)

We begin by determining the riskfree interest rate implied by a box spread and see if i...View the full answer

Answered By

Anurag Agrawal

I am a highly enthusiastic person who likes to explain concepts in simplified language. Be it in my job role as a manager of 4 people or when I used to take classes for specially able kids at our university. I did this continuously for 3 years and my god, that was so fulfilling. Sometimes I've skipped my own classes just to teach these kids and help them get their fair share of opportunities, which they would have missed out on. This was the key driver for me during that time. But since I've joined my job I wasn't able to make time for my passion of teaching due to hectic schedules. But now I've made a commitment to teach for at least an hour a day.

I am highly proficient in school level math and science and reasonably good for college level. In addition to this I am especially interested in courses related to finance and economics. In quest to learn I recently gave the CFA level 1 in Dec 19, hopefully I'll clear it. Finger's crossed :)

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

7. Given : (i) Losses follow exponential distribution with mean 1000. (ii) There is a deductible of 500. each (i) 10 losses are expected to exceed the deductible / year. A. Determine the amount to...

-

The Hilt Company, a public relations company, signs two-year contracts with its clients. For $80,000 in advance, the company agrees to ensure that the clients name is mentioned five times on a...

-

EZCUBE Corp. is 50% financed with long-term bonds and 50% with common equity. The debt securities have a beta of .15. The companys equity beta is 1.25. What is EZCUBEs asset beta?

-

The big disadvantage of billboards is their extremely high cost per location. T F

-

Kalin Corporation had 2010 net income of $1,000,000. During 2010, Kalin paid a dividend of $2 per share on 100,000 shares of preferred stock. During 2010, Kalin had outstanding 250,000 shares of...

-

Requirement 1. Journalize Lakewood's July transactions. (You do not need to record the cost of goods sold entries.) July 2: Sold $50,000 of merchandise to Oceanside Jewels on account Sales Revenue...

-

Assume the same underlying stock, same time to expiration, and same strike price for all derivatives in this problem. Which of the following must have the same profit as a floor coupled with a...

-

CornGrower is going to sell corn in one year. In order to lock in a fixed selling price, CornGrower buys a put option and sells a call option on each bushel, each with the same strike price and the...

-

The CFO of The Chop Shop has determined that the companys degree of operating leverage (DOL) is 2.5 and that its degree of financial leverage (DFL) is 3.0. According to this information, how will the...

-

Level 98%: x1 = 49, n1 = 74, x2 = 62, n2 = 153 In Exercises 712, construct the confidence interval for the difference p1 p2 for the given level and values of x1, n1, x2, and n2.

-

Let X be a continuous random variable with the following PDF Find the MGF of X, M X (s). fx(x) = +) == 12e-1|2|1 e-A/).

-

The number of hours spent studying per day by a sample of 28 students In Exercises 2326, use technology to draw a box-and-whisker plot that represents the data set. 2 8 7 2 261 82 35 37 25 20 73 83...

-

The English statistician Karl Pearson (1857-1936) introduced a formula for the skewness of a distribution. P = 3 ( x median ) s Pearson's index of skewness Most distributions have an index of...

-

You are to specify an orifice meter for measuring the flow rate of a $35^{\circ} \mathrm{API}$ distillate $(\mathrm{SG}=0.85$ ) flowing in a $2 \mathrm{in}$. sch 160 pipe at $70^{\circ} \mathrm{F}$....

-

In each case, find a matrix P such that P-1AP is in block triangular form as in Theorem 1. (a) (b) (c) 323 034 112 344 2210 3202 6331 3211

-

Determine by direct integration the values of x for the two volumes obtained by passing a vertical cutting plane through the given shape of Fig. 5.21. The cutting plane is parallel to the base of the...

-

Fence posts for a particular job cost $10.50 each to install, including the labor cost. They will last 10 years. If the posts are treated with a wood preservative they can be expected to have a...

-

A piece of property is purchased for $10,000 and yields a $1000 yearly net profit. The property is sold after 5 years. What is its minimum price to breakeven with interest at 1O%?

-

Rental equipment is for sale for $110,000. A prospective buyer estimates he would keep the equipment for 12 years and spend $6000 a year on maintaining the equipment. Estimated annual net receipts...

-

Visit the website for one of the following companies, or a different company of your choosing Coca-Cola www.coca-cola.com Bridgestone www.bridgestone.com Motorola www.motorola.com Casio www.casio.com...

-

Question 3 Beta Coefficient [2 points]: Of the $10,000 invested in a two-stock portfolio, 40 percent is invested in Stock A and 60 percent is invested in Stock B. If Stock A has a beta equal to 2.0...

-

Pelzer Printing Inc. has bonds outstanding with 9 years left to maturity. The bonds have a 8% annual coupon rate and were issued 1 year ago at their par value of $1,000. However, due to changes in...

Study smarter with the SolutionInn App