Two actuaries, A and B, use a two-period binomial forward tree to compute the prices of a

Question:

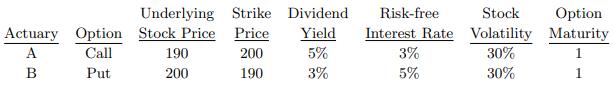

Two actuaries, A and B, use a two-period binomial forward tree to compute the prices of a European call and a European put using different parameters.

You are given:

Describe the relationship between the call price computed by Actuary A and the put price computed by Actuary B.

Transcribed Image Text:

Actuary Option A Call B Put Underlying Strike Stock Price Price 200 190 190 200 Dividend Risk-free Stock Yield Interest Rate Volatility 5% 30% 3% 30% 3% 5% Option Maturity 1 1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

The relationship between the call price computed by Actuary A and the put price computed by Actuary ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

E-levy and elasticity of demand for electronic transaction services. Consider the following facts about mobile money transactions. Currently, MTN and AirtelTigo charge 1% on mobile money transactions...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The price of a stock is $40. A six-month European call option on the stock with a strike price of $30 has an implied volatility of 35%. A six month European call option on the stock with a strike...

-

A quality of information demonstrated when different independent observers could reach the same general conclusions that the information represents what it purports to represent is: O a...

-

What is a pension plan settlement? Curtailment? How should the net gain or loss from a settlement or curtailment be accounted for by a company according to FASB Statement No. 88?

-

On June 5, 2018, Javier Sanchez purchased and placed in service a new 7-year class asset costing $560,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez...

-

Delta Air Lines subcontracted the janitorial work of its offices at the Los Angeles International Airport to the National Cleaning Company. National entered into a collective bargaining agreement...

-

These are the assumptions, principles, and constraints discussed in this and previous chapters. 1. Economic entity assumption. 2. Expense recognition principle. 3. Monetary unit assumption. 4....

-

Gateways only show decisions and possible branching as a result of the decision. Select one: True False PART I. APPLICATION. (20 Marks) Direction: Read the following Caselets and answer the...

-

The graph below illustrates a market for cigarettes. Use it to answer the questions that follow. a. Based only on the graph, are there positive or negative externalities associated with cigarettes?...

-

You want to be a millionaire when youretire in 40 years. How much do you have to save each month if you can earn anannual return of 10.5 percent? How much do you have to save each month if you wait10...

-

What prices and costs are to be used in calculating the future cash flows for purposes of the SMOG disclosure?

-

Compute the standard deviation"sigma symbol"for ages of British nurses in 1851. Assume that the table below shows the age distribution of nurses in Great Britain in 1851. Round your answer to nearest...

-

SOUTHWEST AIRLINES: PROFILE OF A LEADER Airlines have faced economic difficulties with rising fuel costs and increased security standards. While many airlines have faced bankruptcy and corpo- rate...

-

a-1.If the required return is 11 percent, what is the profitability index for both projects? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project...

-

More info Mar. 1, 2024 Dec. 1, 2024 Dec. 31, 2024 Dec. 31, 2024 Jan. 1, 2025 Feb. 1, 2025 Mar. 1, 2025 Mar. 1, 2025 Borrowed $585,000 from Bartow Bank. The nine-year, 5% note requires payments due...

-

Describe the Leader(s) - Leadership Qualities/Style of Captain America in the movie The Avengers 1 (2012) Describe the actions that illustrate specific leadership characteristics and behaviors of...

-

Let A and B be n n matrices. Prove that if Ax = Bx for all n 1 matrices x, then A = B.

-

Fill in each blank so that the resulting statement is true. A solution to a system of linear equations in two variables is an ordered pair that__________ .

-

What is the primary distinction between financial accounting and managerial accounting?

-

Describe the relatioliship among the accounting process, accounting information, decision makers, and economic activities.

-

What are some examples of nonfinancial information that is often used by management in performing its duties?

-

The following is information related to Conan Real Estate Agency. Oct. 1 Arnold Conan begins business as a real estate agent with a cash investment of $18,000 in exchange for common stock. 2 Hires an...

-

Audrey is a degree candidate at her local state college. She received a scholarship for $5,000. She applied the amount to her tuition, which totaled $10,000. How much, if any, of the scholarship is...

-

John Walters is comparing the cost of credit to the cash price of an item. If John makes a down payment of $125 and pays $35 a month for 24 months, how much more will that amount be than the cash...

Study smarter with the SolutionInn App