Question: You are given the following generic Black-Scholes-type pricing function: and all variables are positive. Your boss, who knows nothing about option pricing, has asked you

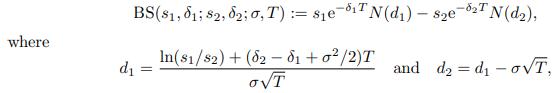

You are given the following generic Black-Scholes-type pricing function:

and all variables are positive.

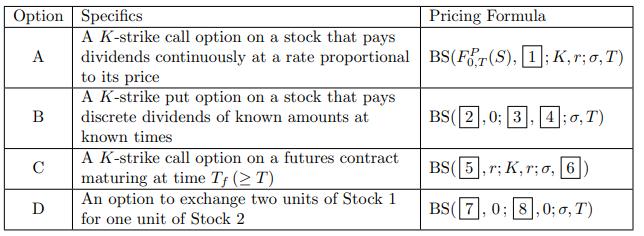

Your boss, who knows nothing about option pricing, has asked you to analyze the following T-year European options. Allergic to formulas, he wants you to simplify notation and express the Black-Scholes pricing formulas of these options in terms of the BS function above: (r is the continuously compounded risk-free interest rate)

(a) Using standard notation in this book, fill in 1 to 8 in the above table.

(b) Explain to your boss the verbal meaning of σ for options B and D.

where BS(81, 81; 82, 82; 0, T): se-TN(d)-82e-82T N(d), In(81/82) + (82 - 8+0/2)T OVT d = and d2d - oT,

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

a The eight blanks should be filled in as follows b For opt... View full answer

Get step-by-step solutions from verified subject matter experts