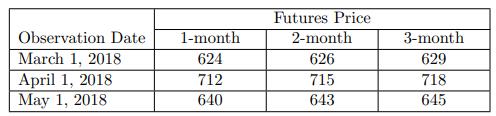

You are given the following historical futures prices of the P&K 689 Index observed at different time

Question:

You are given the following historical futures prices of the P&K 689 Index observed at different time points for various maturities:

On March 1, 2018, Cyrus decides to take a long position in ten 3-month P&K 689 index futures. Each contract permits the delivery of 250 units of the index. The initial margin is 10% of the notional value, and the maintenance margin is 75% of the initial margin. Cyrus earns a continuously compounded risk-free interest rate of 5% on his margin balance. The position is marked-to-market on a monthly basis.

Calculate the balance in Cyrus’s margin account on the day of the second marking-to-market (i.e., on May 1, 2018).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: